When asking “How do you qualify for Obamacare?”, it is important to understand the eligibility criteria which will determine whether you can access affordable health insurance through this program. In this blog post, we will delve into various factors that affect “how do you qualify for Obamacare”.

We’ll discuss citizenship and residency requirements, emphasizing legal residency status and certain exclusions. Income levels and financial assistance play a significant role in determining your eligibility; thus, we’ll explore premium tax credits based on Federal Poverty Level (FPL) guidelines.

Furthermore, we’ll examine the impact of Medicaid expansion under the American Rescue Plan Act on eligibility criteria and compare standard ACA plans with expanded Medicaid options. Employer-sponsored health insurance considerations are essential when assessing the affordability and adequacy of available coverage.

Lastly, we will address marital status and tax filing implications on qualifying for Obamacare while highlighting exceptions allowing separate filings in special cases. We will also discuss coverage options specifically tailored for young adults up to age 26.

By understanding these factors thoroughly, you can better navigate “how do you qualify for Obamacare” and secure comprehensive healthcare coverage suitable for your needs.

Table of Contents

- How Do You Qualify for Obamacare?

- Citizenship and Residency Requirements

- Income Level and Federal Poverty Guidelines

- Employer-Sponsored Coverage vs Obamacare Subsidies

- Marital Status, Tax Filing, and Eligibility for Subsidies

- Coverage Options for Young Adults Under Obamacare

- Conclusion

How Do You Qualify for Obamacare?

When it comes to the question “How do you qualify for Obamacare?”, factors such as citizenship, income level, employment status, marital status, and certain special circumstances may affect the eligibility of an individual. Thus, we will discuss in detail how do you qualify for Obamacare.

Citizenship and Residency Requirements

To qualify for Obamacare, applicants must be US citizens or legal residents. Non-citizens lacking a legitimate immigration standing are not able to join an ACA program. Additionally, incarcerated individuals cannot obtain coverage through the Health Insurance Marketplace.

Ineligibility of Non-Citizens and Incarcerated Individuals

- Non-citizens: Individuals who do not possess lawful immigration status are ineligible for Obamacare coverage; however, they may still receive emergency medical services under certain circumstances.

- Incarcerated individuals: Those currently serving time in jail or prison cannot enroll in an ACA plan but may be eligible upon release if they meet other requirements such as income level, citizenship/residency, etc.

Citizenship and residency requirements are key factors when it comes to “how do you qualify for Obamacare”. Ultimately, analyzing one’s earnings and the federal poverty line is crucial for comprehending the prerequisites of obtaining Obama Care Insurance.

Income Level and Federal Poverty Guidelines

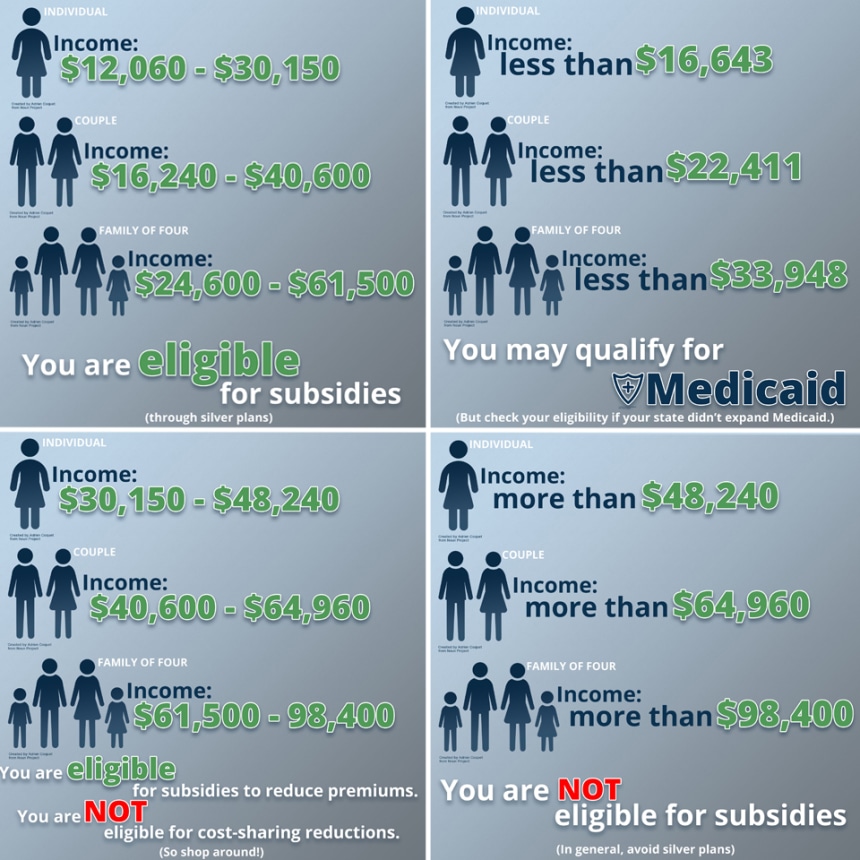

To qualify for Obamacare, applicants must meet specific income requirements based on the Federal Poverty Level (FPL). These guidelines determine eligibility for premium tax credits that can lower monthly premium costs on plans purchased through state-based Marketplaces or Healthcare.gov. Income between 100 and 400 percent of the Federal Poverty Level is necessary for subsidies to be obtained.

Importance of Meeting FPL Guidelines

The American Rescue Plan Act has temporarily increased financial assistance to help uninsured people afford coverage during the COVID-19 pandemic. By meeting the FPL guidelines, families and individuals can access more affordable health insurance options through Obamacare.

Examples of Qualifying Income Ranges

- An individual making an income annually in the range of $12,880 to $51,520 could be eligible for premium tax credits.

- A family of four earning between $26,500 – $106,000 could receive subsidies as well.

Note that these figures are subject to change each year when new federal poverty guidelines are released. It’s essential to stay updated on any changes in order not to miss out on available financial assistance opportunities.

It is important to understand the Federal Poverty Guidelines in order to determine if you qualify for Obama Care Insurance. Moving on, Medicaid Expansion has had a major impact on eligibility and access for lower-income households.

Medicaid Expansion Impact on Eligibility

The ACA has significantly expanded access to health insurance for millions of Americans, in part through the expansion of Medicaid. This expansion allows states to provide coverage to more low-income individuals and families who may not have been eligible under previous guidelines. As a result, many people now qualify for comprehensive healthcare at little or no cost.

States Adopting Medicaid Expansion Policies

Currently, 38 states and the District of Columbia have adopted Medicaid expansion, extending coverage availability even further than before. In these states, eligibility is determined by income levels instead of predetermined criteria such as disability status or family size, thus enabling more uninsured people to gain access to affordable healthcare services.

Lower-Income Households Benefiting from Expanded Access

If you reside within one of the states that have adopted Medicaid expansion and your household income falls below 138% of the Federal Poverty Level (FPL), then you may be eligible instead for Medicaid. An individual with an annual income of less than $17k or a family earning about $35k/year may qualify for Medicaid benefits, as outlined by the Federal Poverty Guidelines set forth each year by HHS.

- American Rescue Plan Act: Under this recent legislation signed into law in March 2023, additional financial support is available through enhanced premium tax credits for those who qualify. This includes people with incomes below 150% FPL, making it even more affordable to obtain coverage through the Health Insurance Marketplace.

- Expanded Medicaid: In states that have expanded their Medicaid programs, eligible individuals can access comprehensive healthcare services at little or no cost, providing a valuable safety net for lower-income households.

Employer-Sponsored Coverage vs Obamacare Subsidies

If you already have access to employer-sponsored health insurance or other forms of minimum essential coverage like Medicare, Medicaid, or CHIP, you might not be eligible for premium tax credits on Marketplace plans. However, there are exceptions in cases where your existing plan is deemed unaffordable or does not provide adequate coverage.

Affordability and Minimum Value Standards

The ACA has set out conditions to determine if a health plan is considered reasonably priced and provides enough coverage. A plan is deemed unaffordable if it costs more than 9.83% of your household income for the lowest-priced option available through your employer. On the other hand, a plan fails to meet the minimum value standard if it covers less than 60% of total healthcare costs.

Exceptions Allowing Individuals to Seek Financial Assistance Through Obamacare

- Inadequate Employer Coverage: If your current employer-sponsored health insurance doesn’t meet affordability or minimum value standards as defined by the ACA, you may qualify for premium tax credits when purchasing a Marketplace plan under the American Rescue Plan Act.

- Lack of Access to Employer-Sponsored Insurance: In some cases, employees may not have access to employer-sponsored health insurance due to part-time status or waiting periods before coverage begins. These individuals can explore their options through state-based Marketplaces or Healthcare.gov and potentially receive subsidies based on their income level.

- Gaps in Coverage: Uninsured people who experience a gap in coverage, such as losing their job or aging out of a parent’s plan, can also qualify for financial assistance through Obamacare. They may be eligible for premium tax credits, cost-sharing reductions, or expanded Medicaid depending on their income and state of residence.

Marital Status, Tax Filing, and Eligibility for Subsidies

To qualify for premium tax credits under Obamacare, married couples must file their federal income tax returns jointly. This requirement ensures that both spouses’ incomes are considered when determining eligibility for subsidies based on the Federal Poverty Level (FPL).

Importance of Filing Taxes Jointly if Married

- Filing a joint tax return allows both partners to benefit from available deductions and credits.

- A joint return can result in lower overall taxes owed compared to separate filings.

- Jointly filed returns simplify the process of calculating household income for ACA subsidy eligibility purposes.

Exceptions Due to Special Circumstances

In some cases, married individuals might be exempt from having to file jointly in order to receive premium tax credits. These exceptions include:

- Domestic abuse: If one spouse is experiencing domestic violence at the hands of their partner, they may qualify for an exemption allowing them to claim subsidies without needing joint-filing status. The Health Insurance Marketplace has more information on this exception and how victims can apply safely without alerting their abuser here.

- Spousal abandonment: When one spouse has abandoned the other and cannot be located, the remaining partner may still qualify for premium tax credits without filing a joint return. To learn more about this exception, visit the IRS’s page on Questions and Answers on the Premium Tax Credit.

Coverage Options for Young Adults Under Obamacare

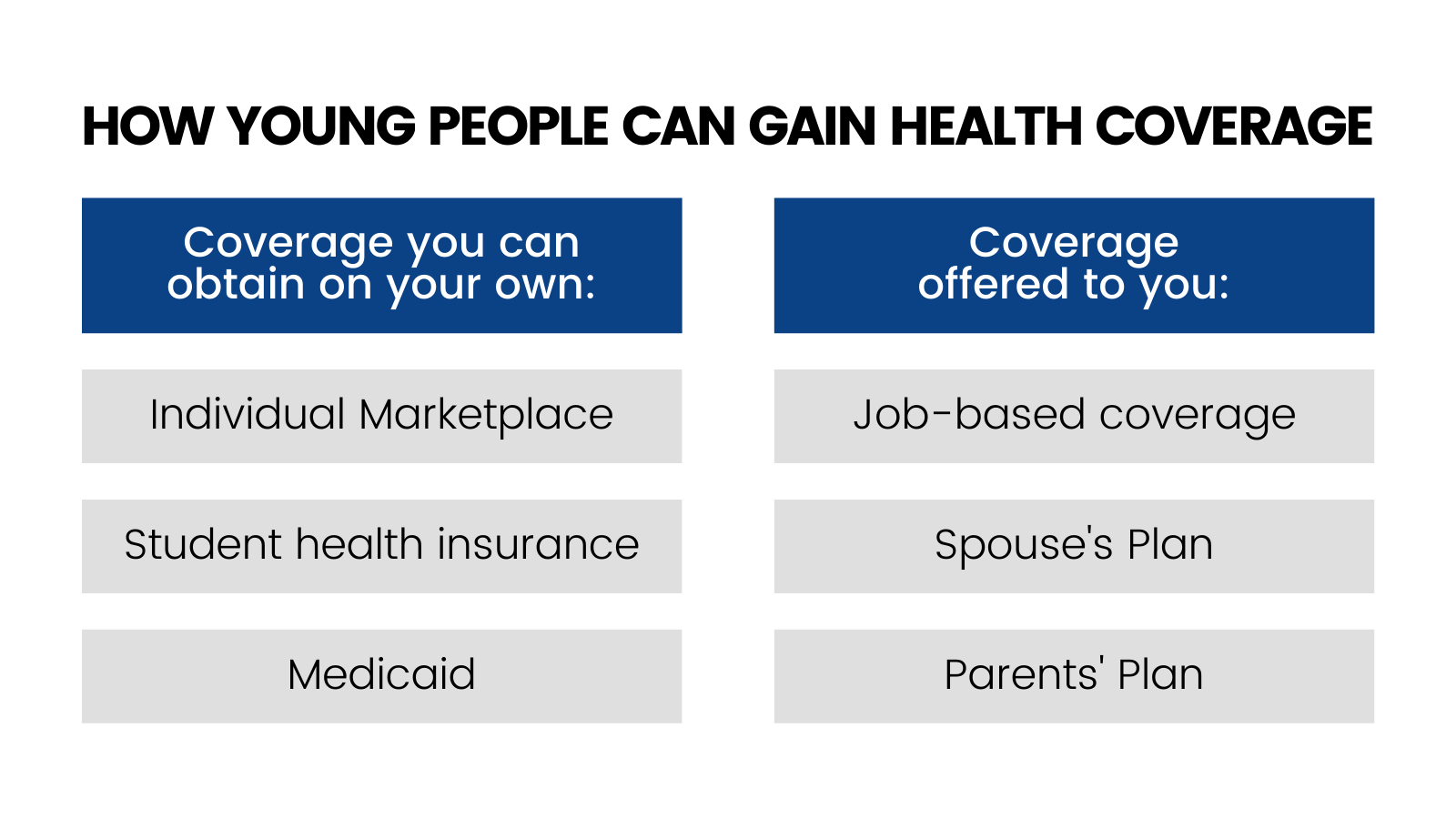

Under Obamacare, young adults are provided a safety net in the form of extended coverage up to age 26 on their parent’s health insurance policy. This extended coverage period offers a safety net for many young adults, regardless of their marital status, schooling, or living situation.

Extended Coverage Period up to Age 26

The ACA stipulates that all individual and group health plans with dependent coverage must extend this option to kids until they hit age 26. It’s important to note that this rule applies even if you’re no longer considered a dependent on your parent’s tax return or are eligible for employer-sponsored coverage through your own job.

Benefits Available Regardless of Marital Status, Schooling, or Living Situation

- Marital Status: Even if you get married before turning 26, you can still be covered under your parent’s plan as long as other eligibility criteria are met.

- Schooling: Your enrollment in school does not affect your ability to remain on your parent’s insurance plan. Whether attending college full-time or taking a break from education altogether – both scenarios allow continued access.

- Living Situation: You don’t have to live with your parents or rely on them financially in order to qualify for this coverage extension; simply being under 26 years old is enough.

Conclusion

In conclusion, factors such as legal residency, employment status, income level, marital status, and location are key to determining how do you qualify for Obamacare. With the recent passage of the American Rescue Plan Act, there are new opportunities for uninsured people to get coverage through the ACA marketplace. If you’re uninsured or underinsured, it’s worth exploring your options to see how do you qualify for Obamacare.