If you’re wondering how do you get on Obamacare, this comprehensive guide will walk you through the process and provide valuable insights into obtaining health insurance under the Affordable Care Act (ACA). Gaining an understanding of key components and eligibility criteria is essential for the successful navigation of the health insurance world, making securing coverage easier.

Additionally, we’ll explore how to use eHealth’s platform to compare plans effectively and discuss important enrollment periods that could impact your ability to obtain coverage. Lastly, we’ll delve into financial assistance options available under ACA such as premium tax credits and cost-sharing reduction benefits.

By reading this blog post, you can gain the knowledge to make informed decisions regarding your healthcare needs while learning how do you get on Obamacare.

Table of Contents

- Understanding Obamacare and Eligibility

- Key Components of the Affordable Care Act

- How Do You Get on Obamacare: Eligibility Criteria

- Using eHealth to Compare Plans

- Enrollment Periods for Obtaining Coverage

- Financial Assistance Options under ACA

- Conclusion

Understanding Obamacare and Eligibility

The Affordable Care Act (ACA), commonly known as Obamacare, aims to provide affordable health insurance for millions of Americans. To be eligible for coverage through the marketplace, individuals must be US citizens or legal residents without access to affordable employer-sponsored coverage.

Key Components of the Affordable Care Act

- Health Insurance Marketplace: A platform where families and individuals can compare different insurance companies plans and enroll in a suitable one.

- Mandatory Coverage: The ACA requires most people to have health insurance or face penalties.

- No Denial Based on Preexisting Health Conditions: Insurance companies cannot deny coverage due to preexisting conditions under the ACA.

- Premium Subsidies: Financial help is available for those who meet income requirements, making premiums more affordable.

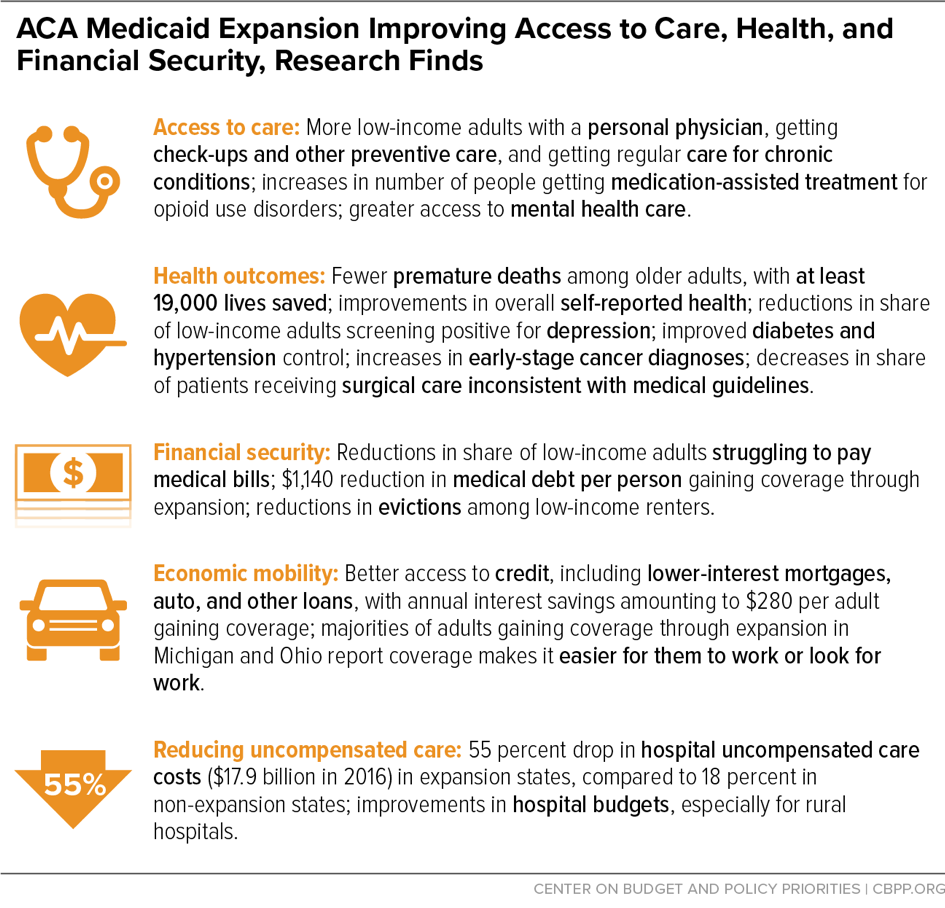

- Coverage Expansion: States can expand Medicaid eligibility, providing low-income adults with access to healthcare services.

- Mandated Preventive Services: All new health plans must cover certain preventive services without charging copayments or coinsurance fees.

How Do You Get on Obamacare: Eligibility Criteria

There are several factors that determine an individual’s eligibility for “how do you get on Obamacare”. These include citizenship status, residency status, availability of employer-sponsored coverage options, and household income. Below are some key points to consider when determining eligibility:

- Citizenship and Residency: Applicants must be US citizens or legal residents.

- No Access to Affordable Employer-Sponsored Coverage: Those with access to affordable coverage through their employer are generally not eligible for financial assistance in the marketplace.

- Income Requirements: Financial help is available for those whose income falls between 100% – 400% of the federal poverty level. The exact amount of assistance depends on your household size and income relative to the poverty level.

It is important to understand the key components of Obamacare and the eligibility criteria for “how do you get on Obamacare” in order to make an informed decision. EHealth can provide a convenient way to contrast plans, so that one may identify the plan most suited for them.

Using eHealth to Compare Plans

The eHealth platform is an invaluable resource for families and individuals looking at “how do you get on Obamacare”. It simplifies the process of comparing ACA-compliant health insurance plans from different providers, enabling users to make informed decisions about which plan best suits their healthcare needs and budget. This helps you make informed decisions about which plan best suits your healthcare needs while staying within your budget constraints.

Navigating the eHealth Platform

To get started with comparing health insurance plans on eHealth, follow these simple steps:

- Visit the Individual & Family Health Insurance page on their website.

- Enter your zip code and some basic information about yourself and any dependents who need coverage.

- Browse through available plans in your area, filtering by premium cost, deductible amount, provider network type, or other preferences as needed.

- Select a plan that meets both your healthcare requirements and financial limitations.

- If qualified for financial aid based on income or pre-existing medical issues, make sure to include it in the application so that it’s reflected in the final expense when getting a policy.

Exploring eHealth to evaluate plans can aid in selecting the optimal coverage for you. Additionally, understanding enrollment periods is key in obtaining health insurance coverage through Obama Care; let’s take a look at what this entails.

Enrollment Periods for Obtaining Coverage

The ACA has a defined period when individuals can get new coverage or modify existing plans under the health care reform law. These include the Open Enrollment Period, Special Enrollment Period, and Medicaid/CHIP enrollment opportunities depending on eligibility requirements and life events experienced by applicants.

Details of the Open Enrollment Period

An important aspect of “How do you get on Obamacare” is the Open Enrollment, an annual window when individuals without health insurance can enroll in coverage through the ACA marketplace. The Open Enrollment Period runs from November 1st to December 15th annually, and plans purchased during this time take effect on January 1st of the following year. Plans purchased during this time become effective on January 1st of the following year.

Qualifying Life Events Triggering Special Enrollment Periods

If you experience certain significant changes in your life outside of the Open Enrollment window, such as getting married, having a baby, losing job-based coverage, or moving to a new state with different available plans, you may qualify for a Special Enrollment Period (SEP). SEPs usually last for 60 days from the date of your qualifying event, allowing eligible individuals to enroll in or change their health insurance plans outside regular open enrollment periods.

Medicaid/CHIP Enrollment Process

If you’re eligible for Medicaid or the Children’s Health Insurance Program (CHIP), there is no specific enrollment period. You can apply at any time throughout the year. Those who meet certain income and other criteria may be eligible for Medicaid or CHIP, both of which provide health coverage options.

To ensure coverage under the ACA, it is critical to familiarize yourself with available enrollment periods and potential financial assistance options. Financial assistance options also exist for those who qualify, so let’s explore what type of support may be available.

Financial Assistance Options under ACA

These include premium tax credits and cost-sharing reductions, both designed to lower out-of-pocket costs associated with purchasing a policy through the marketplace.

Premium Tax Credits Explained

Premium tax credits are available for those whose income falls between 100% and 400% of the federal poverty level. FPL guidelines can be found here. The sum you obtain is contingent on your family size, salary, and the expense of schemes in your locality.

- To apply: When applying for coverage through the Health Insurance Marketplace, provide accurate information about your household size and income so that they can determine if you’re eligible for premium tax credits.

- Credit usage: You have two options when using these credits: either apply them directly to reduce monthly premiums or claim them as a lump sum when filing taxes at year-end.

- Income changes: It’s essential to report any changes in income or family size promptly since it may affect eligibility or credit amounts received throughout the year.

Cost-Sharing Reductions Benefits

If your annual household income is below 250% of FPL, you may also qualify for cost-sharing reductions (CSRs). CSRs are additional subsidies that lower out-of-pocket costs, such as deductibles, copayments, and coinsurance. To be eligible for CSRs:

- You must enroll in a Silver plan through the Health Insurance Marketplace.

- Report any changes to your income or household size promptly since it may affect eligibility for CSRs.

Financial aid opportunities enabled by the ACA are created to assist in making health insurance more accessible for those who meet certain criteria. The American Rescue Plan Act has made further changes that can impact how much financial assistance individuals and families receive when purchasing an Obamacare plan.

Conclusion

In conclusion, understanding the Affordable Care Act (ACA) and its eligibility criteria is the first step in “How do you get on Obamacare”. Utilizing eHealth to compare plans can help individuals and families find the best insurance options for their needs. Overall, by following the guidelines outlined above, individuals and families can access quality health insurance at an affordable price, even if they have preexisting health conditions.