Grasping the means how to get health care without a job is an absolute necessity for people and households in this difficult circumstance. In today’s complex healthcare landscape, there are several options available that can provide coverage even when you’re unemployed. This blog post will explore various avenues through how to get health care without a job.

We’ll look into various options such as COBRA continuation coverage, federal healthcare programs like Medicare and Medicaid, joining a family member’s employer-based plan, or opting for short-term health insurance plans. Additionally, we’ll delve into joining a family member’s employer-based plan or opting for short-term health insurance plans.

Furthermore, alternative healthcare options like group health plans offered by University Alumni Associations and health expense-sharing ministries will be covered. Lastly, we’ll examine community health centers and specific provisions for young adults under 26 years old seeking coverage.

By the end of this comprehensive guide on how to get health care without a job, you’ll have gained valuable insights into navigating your way toward securing adequate medical services during times of unemployment.

Source

Note that while maintaining COBRA continuation coverage offers stability during uncertain times, it is essential to not only explore alternative options but also keep track of when open enrollment periods begin so as not to miss out on potentially more affordable health insurance plans.

COBRA Continuation Coverage may be a beneficial choice for individuals who have experienced job loss and are seeking to retain health insurance. However, if you don’t qualify or cannot afford COBRA, there are other federal healthcare programs available that may be able to provide assistance with your medical expenses.

Source

Note that while maintaining COBRA continuation coverage offers stability during uncertain times, it is essential to not only explore alternative options but also keep track of when open enrollment periods begin so as not to miss out on potentially more affordable health insurance plans.

COBRA Continuation Coverage may be a beneficial choice for individuals who have experienced job loss and are seeking to retain health insurance. However, if you don’t qualify or cannot afford COBRA, there are other federal healthcare programs available that may be able to provide assistance with your medical expenses.

Source

Source

Source

Source

Table of Contents

- How to get Health Care without a Job through COBRA Continuation Coverage

- How to get Health Care without a Job through Federal Healthcare Programs

- Joining Family Member’s Employer-Based Plan

- Short-Term Health Insurance Plans

- Alternative Healthcare Options

- Community Health Centers

- Coverage for Young Adults Under 26 Years Old

- Conclusion

How to get Health Care without a Job through COBRA Continuation Coverage

If you have recently lost your job, the Consolidated Omnibus Budget Reconciliation Act (COBRA) allows you to maintain your former employer’s health plan under certain circumstances. While this option can be pricey (averaging around $600 a month), it provides continuity of care and access to familiar provider networks.Understanding Eligibility for COBRA Coverage

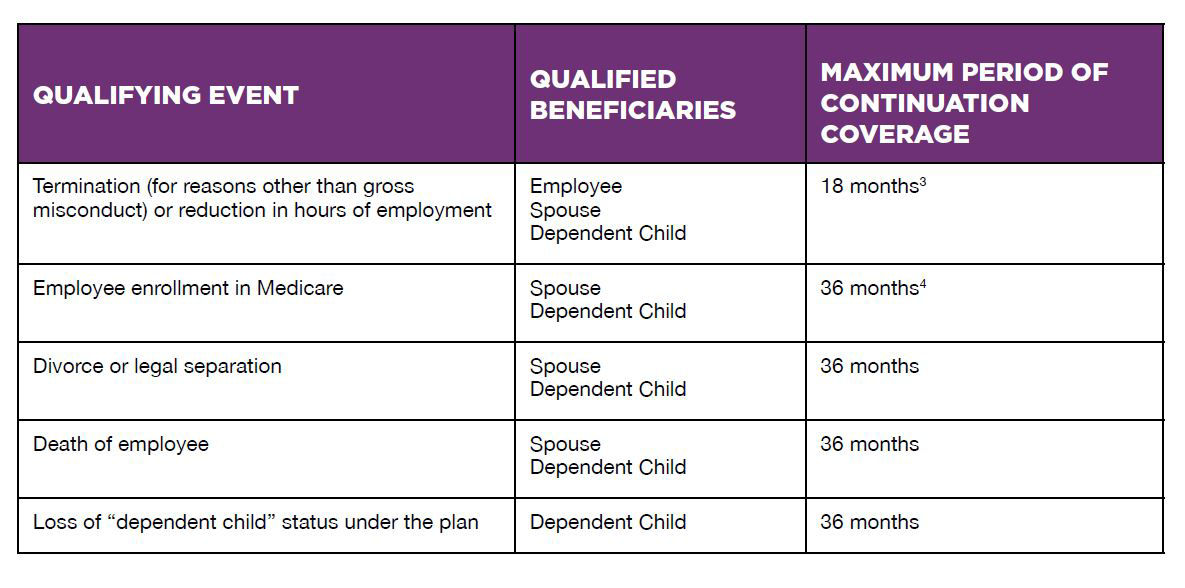

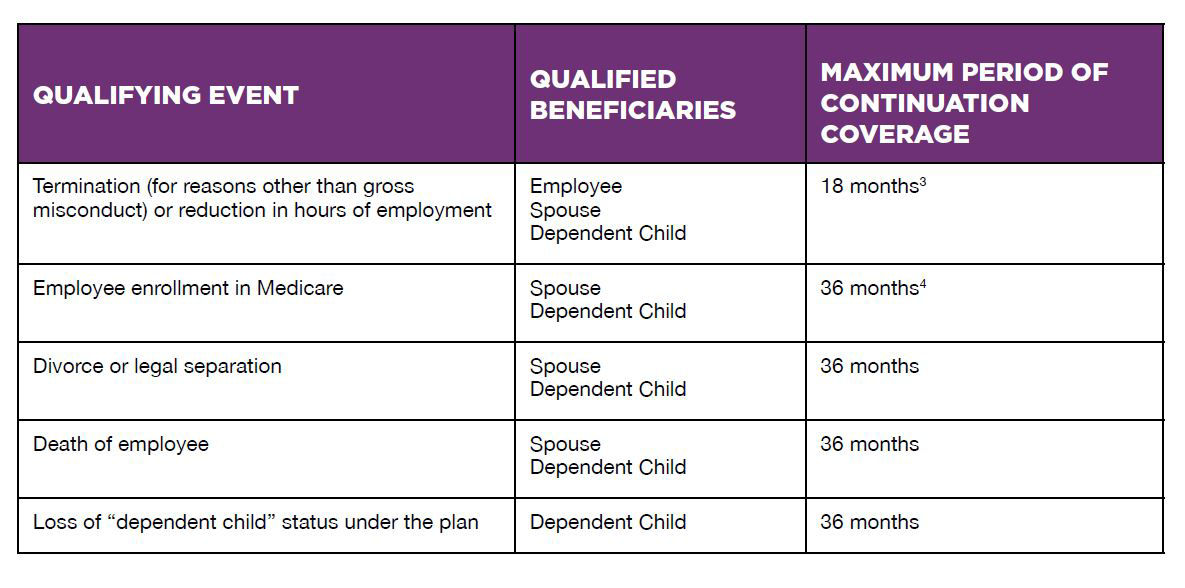

To qualify for COBRA continuation coverage, you must meet specific criteria such as being covered by a group health plan provided by an employer with 20 or more employees on more than half its typical business days in the previous calendar year. Additionally, there should be a qualifying event like termination of employment or reduction in work hours that led to loss of insurance coverage. For detailed information about eligibility requirements, visit the HealthCare.gov website.How Long You Can Stay on Your Former Employer’s Plan

The duration of COBRA continuation coverage depends on various factors including the type of qualifying event and whether any extensions apply due to disability status or other reasons. Generally speaking:- If you lose your job involuntarily or experience reduced working hours: You may receive up to 18 months of continued healthcare benefits.

- In cases involving divorce, legal separation, or death of an employee’s spouse: Dependents are eligible for up to 36 months after these events occur.

-

Save

Lost your job but need health insurance? COBRA continuation coverage allows you to maintain your former employer’s plan. Learn more at HealthCare.gov #healthcare #COBRAcoverage Click to Tweet

How to get Health Care without a Job through Federal Healthcare Programs

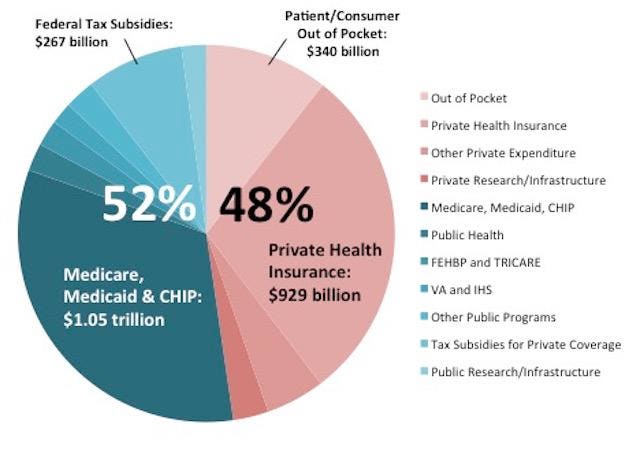

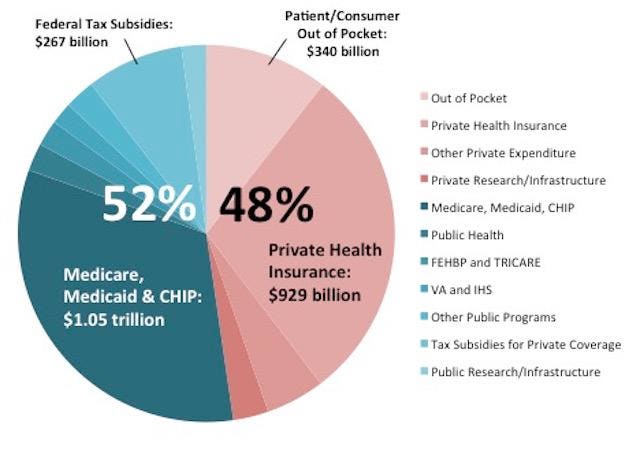

Various federal programs such as Medicare, Medicaid, Children’s Health Insurance Program (CHIP), and Advance Premium Tax Credits offer healthcare coverage based on age or income levels. These options cater specifically to different groups of people wondering how to get health care without a job.

-

Save

Medicare for Seniors Aged 65 Years and Older

Medicare is a federally funded health insurance program designed primarily for individuals who are 65 years old or older. It furnishes complete medical advantages, including inpatient services, outpatient care, prescriptions and more. Eligibility requirements can be found at the official Medicare website: medicare.gov/eligibilitypremiumcalc.Medicaid Offering Free or Low-Cost Healthcare Services Based on Financial Situation

Medicaid is a state-run program that offers free or low-cost health insurance coverage to eligible low-income adults, children, pregnant women, and elderly adults with disabilities. Each state has its own set of eligibility rules; however, all states must follow certain federal guidelines regarding income limits and other factors. To check your Medicaid eligibility in your state, visit: healthcare.gov/medicaid-chip/getting-medicaid-chip.CHIP Providing Insurance for Children in Low-Income Families

The Children’s Health Insurance Program (CHIP) offers affordable health coverage to children in families with incomes too high to qualify for Medicaid but who cannot afford private health insurance. CHIP provides a wide range of benefits, including regular check-ups, immunizations, dental care, and more. To learn about the program and apply online, visit: insurekidsnow.gov/state. Federal healthcare programs provide an invaluable service to those who are unable to access healthcare due to their financial situation.Get affordable healthcare coverage without a job through federal programs like Medicare, Medicaid, CHIP, and Advance Premium Tax Credits. Check eligibility now. #ObamaCare #HealthcareCoverage Click to Tweet

Joining Family Member’s Employer-Based Plan

Another option on “how to get health care without a job” is joining a family member’s employer-based plan. If you’re married or part of a family unit where at least one member has employment-based healthcare benefits, joining their plan might be possible if they meet specific requirements outlined by the insurer regarding dependents’ inclusion into existing policies. This option can provide health insurance coverage without having to rely on federal programs like Medicaid or searching for private health insurance plans.Requirements needed to join spouse’s/family member’s policy

To add a dependent onto an employer-sponsored group health plan, certain criteria must be met. Typically, to join a spouse’s/family member’s policy, evidence of the relationship (e.g., marriage certificate) must be provided and legal status verified. For children, eligibility may extend up until they turn 26 years old. It is essential to consult with your family member’s human resources department or review the Summary of Benefits and Coverage (SBC) document provided by the insurer for detailed information about adding dependents.Potential limitations when adding dependents

- Coverage costs: Adding a dependent could increase monthly premiums depending on the type of plan selected and whether it covers individual employees only or entire families.

- Different open enrollment periods: The open enrollment period for your spouse’s/family member’s employer-based plan may differ from other options such as ACA marketplace plans. Ensure that you are cognizant of these dates to guarantee your eligibility for coverage during the allotted time frame.

- Limited network access: Some employer-sponsored plans have limited provider networks which could restrict access to certain medical services or specialists. It is essential to review the plan’s network before joining to ensure your preferred healthcare providers are included.

Secure health insurance coverage without a job. Join your spouse or family member’s employer-based plan by meeting specific requirements. #Obamacare #HealthcareCoverageClick to Tweet

Short-Term Health Insurance Plans

If you require interim medical coverage, short-term health insurance plans could be a possible solution. However, it’s essential to understand the limitations and potential drawbacks associated with these policies before committing.Understanding Limitations of Short-Term Health Insurance Plans

- Exclusionary Clauses: These plans often exclude pre-existing medical conditions from coverage, meaning that if you have any ongoing medical problems or chronic illnesses, this type of plan may not provide adequate protection.

- Limited Benefits: Some short-term policies do not cover maternity care or other essential healthcare services such as mental health treatment and prescription medications. Be sure to carefully review the policy details before purchasing.

- No Renewal Guarantees: Unlike traditional health insurance plans, short-term policies typically do not renew automatically at the end of their term. This can lead to gaps in coverage if you don’t secure another policy promptly after your current one expires.

Don’t risk gaps in healthcare coverage. Learn about the limitations of short-term health insurance plans and explore alternative options for long-term benefits. #healthcare #insurance #ObamaCare Click to Tweet

Alternative Healthcare Options

If traditional health insurance options are not feasible when considering how to get health care without a job, there are alternative healthcare choices that can help you obtain medical services at discounted rates. Two such alternatives include group health plans offered by University Alumni Associations and health expense-sharing ministries.Group Health Plans Offered by University Alumni Associations

Some University Alumni Associations offer group health plans to their members as a way of providing affordable healthcare coverage. These plans may have certain limitations compared to traditional insurance policies but could be worth exploring if you’re an alumnus seeking cost-effective solutions for your medical needs. Be sure to review the plan details carefully before enrolling in any alumni-sponsored program.Health Expense-Sharing Ministries

Health expense-sharing ministries, also known as faith-based sharing programs, allow members to pool their resources together and share each other’s eligible medical bills. While these programs might seem like an attractive option due to lower costs, it is essential to understand that they are not regulated like traditional insurance companies and do not guarantee payment for submitted claims. Moreover, pre-existing conditions and certain treatments may not be covered by these programs.Explore alternative healthcare options like group health plans from alumni associations and health expense-sharing ministries for affordable medical services. #healthcareoptions #affordablemedicalservices Click to Tweet

Community Health Centers

Another option for “how to get health care without a job” is Community Health Centers. They can provide primary care and other medical services to individuals who lack access to affordable healthcare through conventional channels. These facilities operate with a sliding fee scale based on income, allowing them to be accessible even for those without steady work or who are not making enough money.Services provided by community health centers

Federally Qualified Health Centers (FQHCs), as well as other non-profit community-based clinics, offer a range of services including:- Primary care for adults and children.

- Dental care.

- Mental health counseling.

- Prenatal and maternity care.

- Vaccinations and immunizations.

- Laboratory tests and diagnostic imaging.

Sliding fee scales based on income levels

To ensure equitable access to quality healthcare, many community health centers offer sliding fee scales based on income levels. This system adjusts the cost of medical services depending on one’s financial capacity. The Kaiser Family Foundation notes that many FQHCs require proof of income in order for patients to qualify for reduced fees or free treatment options. Community health centers can be a great help to individuals searching for medical coverage, especially those with financial constraints.Accessing healthcare without a job is possible. Community Health Centers offer affordable medical services on a sliding fee scale. Find one near you today. #AffordableHealthcare #CommunityHealthCenters Click to Tweet

Coverage for Young Adults Under 26 Years Old

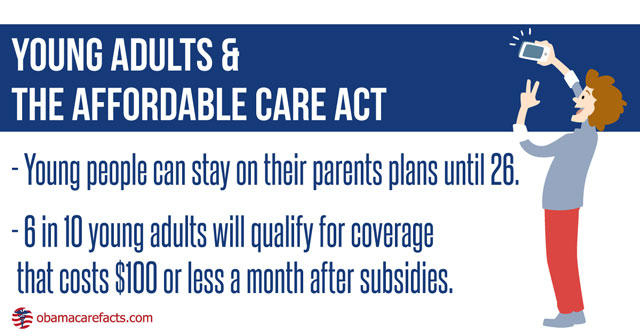

Young adults aged 26 or younger may qualify for coverage under their parents’ policy, subject to the insurer’s eligibility requirements. For those studying, beginning a career, or unable to obtain cost-effective health insurance on their own, this option can be an invaluable asset.

-

Save

Eligibility Criteria for Young Adults Joining Parent’s Plan

To qualify for this benefit under the Affordable Care Act (ACA), young adults must be unmarried and not eligible for employer-sponsored health insurance. Young adults must also be ineligible for government-sponsored health insurance such as Medicaid or Medicare. It is essential to check with your parent’s insurance company regarding specific requirements and any additional limitations that may apply.Exploring Health Cost-Sharing Programs

If joining a parent’s plan isn’t an option or if you’re looking for alternative ways to manage medical costs while uninsured, consider exploring health cost-sharing programs. These programs involve pooling resources among members who contribute monthly fees based on income levels and share expenses when medical needs arise. Some popular options include: Keep in mind that these programs are not traditional insurance plans and may have limitations on coverage for pre-existing conditions or certain medical services. Examine all possibilities carefully prior to choosing.Get covered without a job. Young adults under 26 can join their parent’s insurance plan or explore cost-sharing programs for affordable healthcare. #Obamacare #HealthcareCoverage Click to Tweet

Conclusion

When it comes to “how to get health care without a job”, several options are available like COBRA continuation coverage, Federal healthcare programs like Medicare and Medicaid, joining a family member’s employer-based plan, or opting for short-term health insurance plans. Alternative healthcare options like group health plans offered by University Alumni Associations and Health expense-sharing ministries may work too while community health centers offer sliding fee scales based on income levels. It is important to consider these options to make sure you have a fallback in case any health issues occur during your unemployment.Contact Fiorella Insurance today for your free health insurance quote.