Determining how much is Obama Care for a single person may vary significantly based on several variables. In this blog post, we will examine the various factors that influence how much is Obama Care for a single person, explore different healthcare plans and subsidies available to reduce overall expenses and discuss how recent legislation has made health insurance more accessible.

Furthermore, we will discuss how recent legislation like the American Rescue Plan Act has expanded subsidy eligibility and made healthcare more affordable for many Americans. By understanding all aspects related to “how much is Obama Care for a single person,” you’ll be better equipped to choose a healthcare plan based on your medical needs and financial circumstances.

Table of Contents

- How Much is Obama Care for a Single Person

- Company Offering the Insurance Plan

- Type of Healthcare Plan Selected

- Out-of-Pocket Maximum Limits

- Geographic Location

- Premium Tax Credits & Financial Assistance Programs

- Average Health Insurance Costs & Subsidies Impact

- American Rescue Plan Act & Increased Subsidy Eligibility

- Choosing a Healthcare Plan Based on Medical Needs and Financial Circumstances

- Conclusion

How Much is Obama Care for a Single Person

The cost of ObamaCare, or the Affordable Care Act (ACA), for a single person, varies depending on several factors such as the company offering the plan, the type of plan chosen, and out-of-pocket maximum limits. Additionally, where you live can significantly impact your health insurance costs.

Company Offering the Insurance Plan

Different companies offer various health insurance plans under Obamacare with varying premium rates and coverage options. It’s essential to research different providers to find one that best suits your needs and budget.

Type of Healthcare Plan Selected

The ACA offers five types of health insurance plans: catastrophic, bronze, silver, gold, and platinum. Each type provides different levels of coverage at varying premium rates based on an individual’s income level and healthcare service requirements.

Out-of-Pocket Maximum Limits

- Catastrophic Plans: These plans have low monthly premiums but high out-of-pocket maximums which make them suitable for young adults or those who rarely require medical services.

- Bronze Plans: Bronze plans have lower monthly premiums than other metal tiers but higher out-of-pocket costs when receiving care from covered health service providers.

- Silver Plans: Silver plans strike a balance between affordable premiums and manageable out-of-pocket expenses while still providing comprehensive coverage for most healthcare services needed by individuals with average medical needs.

Geographic Location

Location plays a significant role in determining how much is Obama Care for a single person. States that have expanded Medicaid under the ACA generally offer more affordable coverage options to residents, while those without Medicaid expansion may have higher monthly premiums and fewer choices for individuals seeking coverage.

In addition to these factors, eligibility for premium tax credits and financial assistance programs can greatly impact how much is Obama Care for a single person. It’s crucial to explore all available resources when choosing an insurance plan that meets both your medical needs and financial circumstances.

Weighing up how much is Obama Care for a single person necessitates mulling over parameters such as insurer, healthcare plan chosen, topmost allowable out-of-pocket expenditures, and region.

Premium Tax Credits & Financial Assistance Programs

Undocumented immigrants can receive premium tax credits to reduce their monthly premium costs when they purchase insurance on behalf of another documented individual. Losing employment or experiencing other circumstances, such as childbirth, may make one eligible to receive PTCs when they sign up for Medicaid.

Qualifying Life Events Triggering Eligibility for Financial Assistance Programs

Various life circumstances may make an individual entitled to aid through the ACA. Some examples include:

- Losing health coverage due to job loss, divorce, or aging out of a parent’s plan.

- Having a baby or adopting a child.

- Moving to a new state that offers different health care options.

Enrolling in Medicaid After Losing Employment

If you lose your job and subsequently your employer-sponsored health insurance, it is possible that you qualify for Medicaid. The ACA has enabled individuals earning up to 138% of the federal poverty level in states that have adopted Medicaid expansion to become eligible for coverage.

Obtaining PTCs Through ACA’s Provisions

The ACA provides premium tax credits based on household size and income levels between 100-400% of the federal poverty level. These subsidies help lower-income families afford quality health insurance plans.

Average Health Insurance Costs & Subsidies Impact

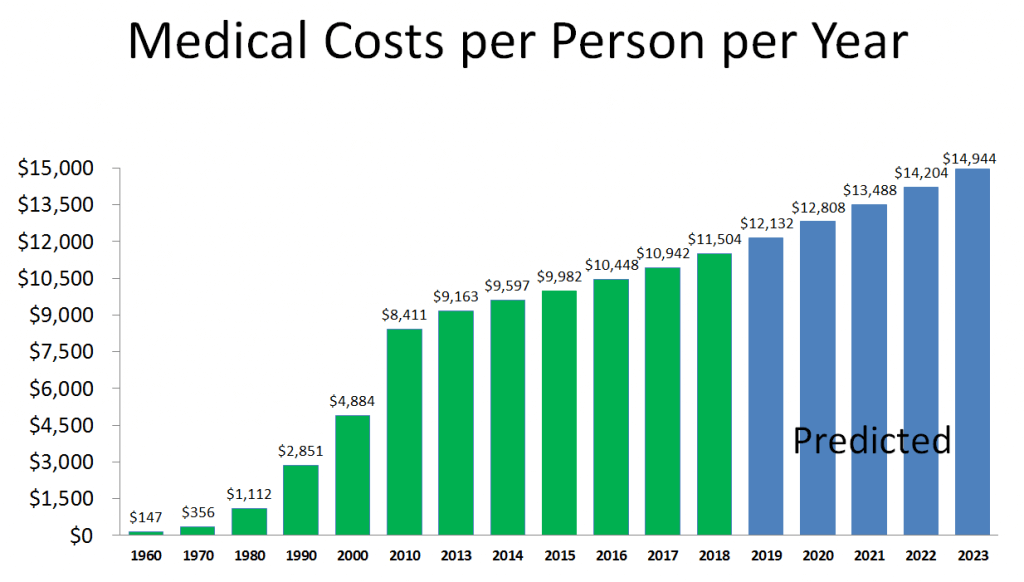

In 2023, the average health insurance cost for individual coverage was $599 per month. However, after applying premium tax credits and other financial assistance programs available under the Affordable Care Act (ACA), many people paid significantly lower monthly premiums. In fact, some individuals only had to pay an average of $47 per month.

Average Monthly Premiums Before Subsidies Application

Before taking into account any subsidies or financial assistance, it’s essential to understand that health insurance costs can vary depending on factors such as your age, location, and chosen plan. A Kaiser Family Foundation study from 2023 found that monthly premiums could range from $331 to as high as $1,375.

Effectiveness Of Subsidies Reducing Monthly Premiums

The ACA provides several types of financial assistance for eligible individuals and families based on their income level and federal poverty guidelines. These include premium tax credits which help reduce monthly premium costs directly at point-of-sale when purchasing a healthcare plan through state-based or federally facilitated marketplaces like HealthCare.gov.

Using Online Tools To Estimate Obamacare Costs

- eHealth: eHealth offers an online tool that allows you to enter your age, location, household size, and income to estimate the cost of Obamacare plans in your area.

- Kaiser Family Foundation: The KFF Subsidy Calculator is another helpful resource for estimating premium tax credits and overall health insurance costs under the ACA.

In order to make informed decisions about healthcare coverage options, it’s crucial to research available resources and understand how subsidies can impact individual plan costs. By utilizing these tools, you’ll be better equipped to choose a suitable health insurance plan based on your unique needs and financial circumstances.

American Rescue Plan Act & Increased Subsidy Eligibility

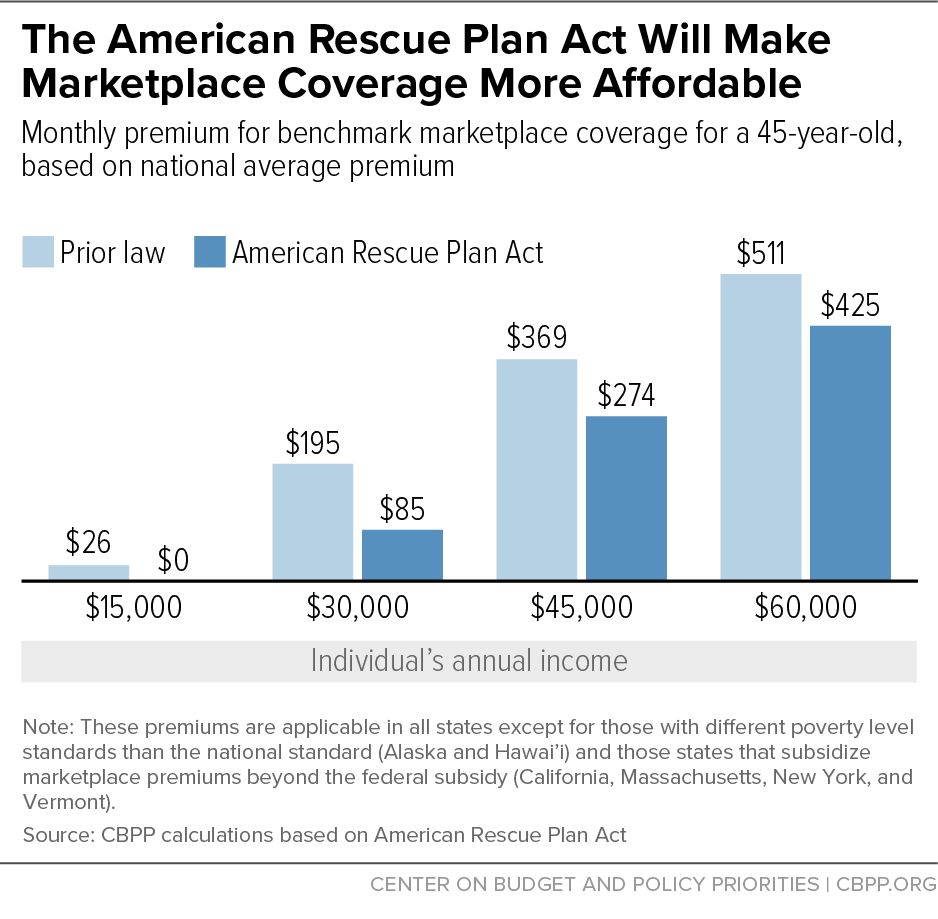

President Biden signed the American Rescue Plan Act into law on March 11th, 2023, which increased the number of Americans who qualified for subsidies by 20%. More individuals now qualify for fiscal aid to help them cover their monthly health insurance premiums. In fact, 18% of Obamacare enrollees paid nothing for coverage due to these supports.

Expanded eligibility for premium tax credits

The American Rescue Plan Act expanded the eligibility criteria for receiving premium tax credits under the Affordable Care Act. Previously, individuals with incomes between 100% and 400% of the federal poverty level (FPL) were eligible; however, under this new legislation, there is no income cap on subsidy eligibility. This means that even those earning above 400% FPL can receive financial assistance if their health insurance costs exceed a certain percentage of their income.

Impact of the American Rescue Plan Act on healthcare affordability

- Increase in Premium Tax Credits: The American Rescue Plan has increased both the amount and availability of premium tax credits provided through Obamacare’s Health Insurance Marketplace. These enhanced subsidies have made it possible for many families and individuals to access affordable healthcare services.

- Coverage Expansion: With an increase in federal funding towards Medicaid expansion efforts across states that have not yet adopted it as part of the Affordable Care Act, more low-income Americans are now able to access affordable health coverage through expanded Medicaid programs.

- COBRA Subsidies: The American Rescue Plan also provides financial assistance for individuals who have lost their jobs and need to maintain their employer-sponsored health insurance plans through COBRA. This support helps them continue receiving care without facing high monthly premiums during a challenging time.

The American Rescue Plan Act has made healthcare more affordable for many Americans by increasing subsidy eligibility. Considering one’s medical needs and financial state is paramount in selecting a healthcare plan to ensure the best coverage at an economical cost.

Choosing a Healthcare Plan Based on Medical Needs and Financial Circumstances

When choosing a healthcare plan, it’s essential to estimate what medical services you’ll need in the upcoming year so you can compare plans accordingly. When selecting a healthcare plan, be mindful of any potential out-of-pocket expenses that may arise from using the services included in your coverage.

Estimating Future Medical Service Needs

To make an informed decision about which health insurance plan is best suited for your needs, consider factors such as pre-existing conditions, family history of health issues, and lifestyle habits. For example:

- If you have a chronic condition requiring regular doctor visits and medication refills, look for plans with lower copayments and better prescription drug coverage.

- If you value preventive care, such as yearly checkups, select a plan that covers these services with minimal or no expense.

- If there’s potential for high-cost treatments (e.g., surgery) within the next year due to ongoing health concerns or planned procedures like childbirth, select a plan with lower out-of-pocket maximum limits.

Comparing Plans Based on Coverage, Deductibles, Copayments & Coinsurance

The Affordable Care Act offers various types of health insurance plans through its marketplace: catastrophic, bronze, silver, gold, and platinum. Each type has different levels of coverage and premium rates. To find one suitable for both your medical needs and financial circumstances:

- Analyze each option carefully considering premiums, deductibles, copays, and coinsurances.

- Use online tools provided by eHealth or similar platforms to compare plans side-by-side based on your specific requirements.

- If you qualify for financial assistance like premium tax credits, make sure the plan you choose is eligible for these subsidies.

By taking time to evaluate all factors involved in selecting a healthcare plan, you can ensure that you’re making the best decision possible both financially and medically.

Conclusion

In conclusion, determining how much is Obama Care for a single person can vary based on several factors. However, there are options for affordable health coverage through Medicaid expansion, the Health Insurance Marketplace, and financial assistance programs. By comparing plans and using available resources, individuals can receive care that fits their healthcare needs and budget.