How much does Obamacare cost per month? This is a critical inquiry for those looking to obtain budget-friendly health coverage through the ACA. In this comprehensive blog post, we will delve into the factors that influence how much does Obamacare cost per month, including location, type of plan, and eligibility for government subsidies.

We’ll provide an in-depth analysis of each tier’s benefits and costs within Obamacare plans. Furthermore, we’ll discuss how your geographical location can significantly impact health insurance premiums and introduce online resources to help estimate personalized costs.

In addition to these key aspects of determining monthly premiums, our discussion will cover recent changes introduced by the American Rescue Plan Act that affect premium tax credits. We’ll also explore special enrollment periods and Medicaid expansion as potential avenues for obtaining coverage at a reduced rate or even free of charge.

By understanding all these components involved in answering “How much does Obamacare cost per month?”, you can make informed decisions about selecting a suitable health insurance plan tailored to your needs and budget.

Table of Contents

- How much does Obamacare Cost Per Month

- Company-provided Coverage Variations

- Types of Health Insurance Plans Under Obamacare

- Out-of-Pocket Maximum Limits

- Government Subsidies Impact on Monthly Premiums

- Obamacare and Undocumented Immigrants

- Losing Employer-Sponsored Healthcare Coverage Options

- Recent Legislative Changes Impacting ACA Costs

- Estimating Expected Healthcare Costs and Choosing Plans Wisely

- Conclusion

How much does Obamacare Cost Per Month

When it comes to “How much does Obamacare cost per month”, it can be impacted by a range of elements, such as the provider, plan selection, and out-of-pocket maximum. These plans must comply with certain federal and state laws to ensure a minimum level of coverage for all enrollees. Location also plays a significant role in determining health insurance costs due to differences in regional pricing structures within states’ healthcare markets.

Company-provided Coverage Variations

Different health insurance companies may offer varying premium rates for similar plans under Obamacare. This is because each company has its own method for calculating risk and setting prices based on its customer base and financial goals.

Types of Health Insurance Plans Under Obamacare

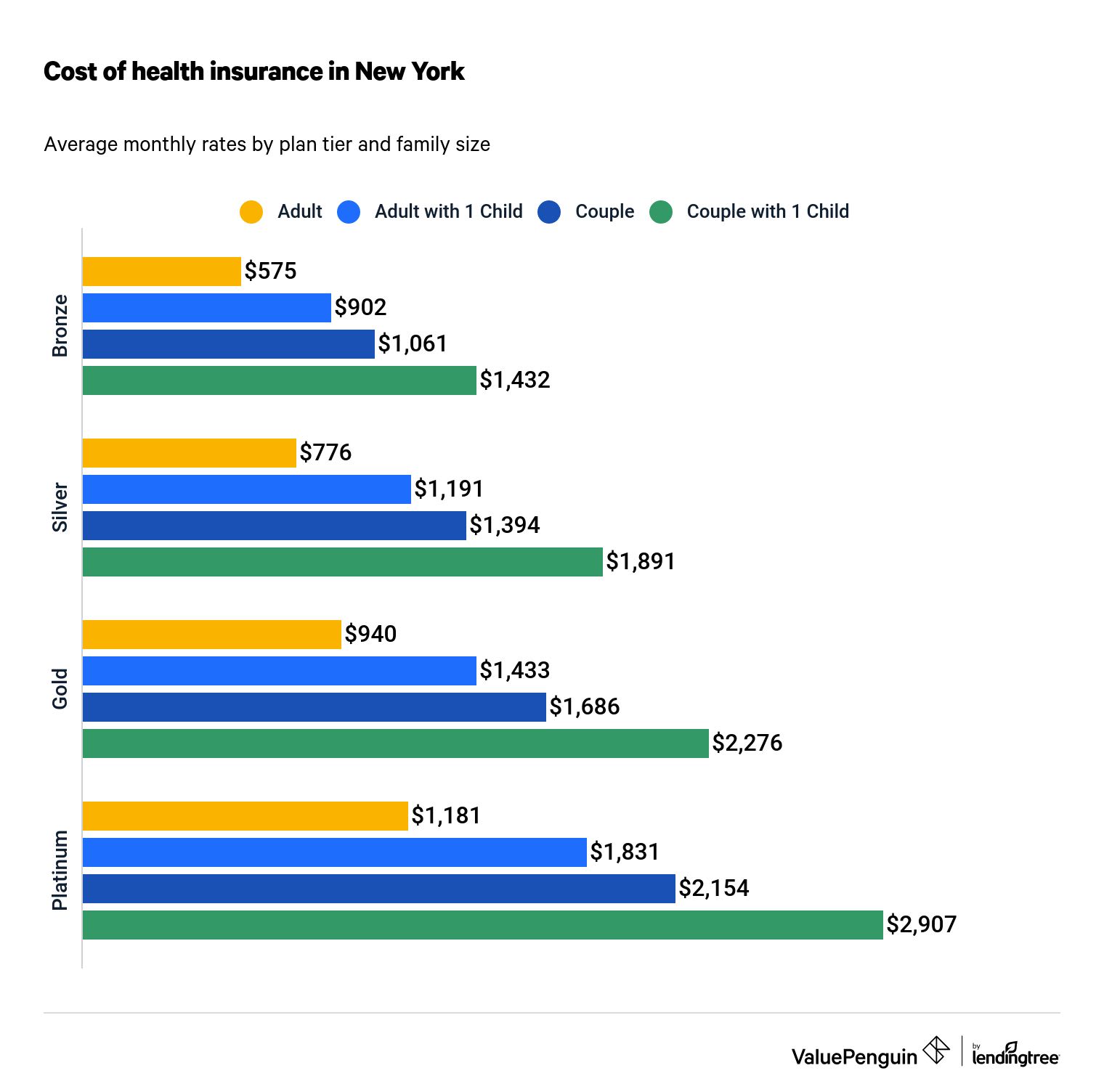

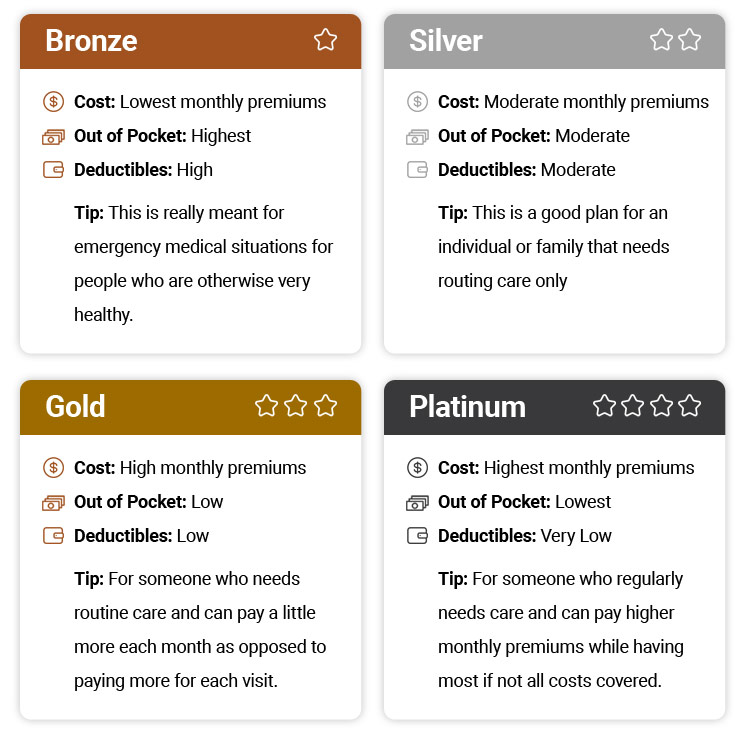

The Affordable Care Act (ACA), also known as Obamacare, offers a variety of health insurance plans to cater to different needs and budgets. The levels of plans are Bronze, Silver, Gold and Platinum; each offering different coverage at distinct price points.

Average Deductible Amounts

- Bronze Plans: These plans typically have the lowest monthly premiums but come with high deductibles averaging around $6,992 in 2023.

- Silver Plans: Offering moderate coverage levels at mid-range prices, Silver Plan deductibles averaged about $4,879 in 2023.

- Gold Plans: With comprehensive coverage and lower out-of-pocket expenses before benefits kick in, Gold Plan deductibles were approximately $1,641 on average during the same period.

- Platinum Plans: The highest level of the Obamacare plan offers extensive coverage at a higher price point; however, their low deductible amounts averaged just around $162 in 2023.

Understanding the deductible amounts and other cost-sharing reductions can help you make informed decisions when selecting a health insurance plan that best suits your needs and budget.

Out-of-Pocket Maximum Limits

An important factor affecting “how much does Obamacare cost per month” is the out-of-pocket maximum limit set by each insurance plan. This refers to the highest amount you will have to pay annually before your insurer covers 100% of your healthcare services expenses. Lower limits typically result in higher monthly premiums but can provide greater financial protection against unexpected medical costs.

Government Subsidies Impact on Monthly Premiums

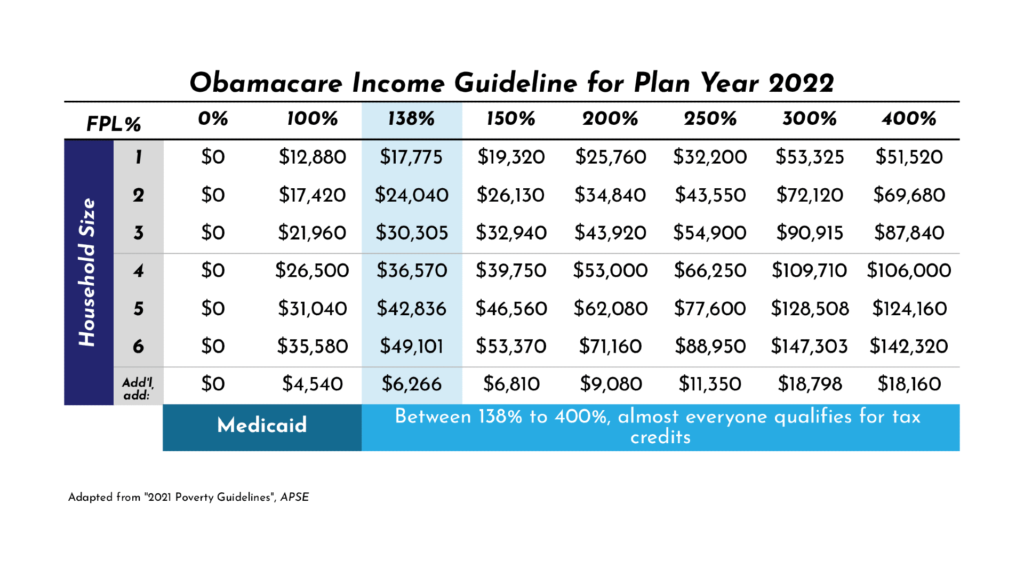

The Affordable Care Act (ACA) provides government subsidies that help lower health insurance premiums for eligible individuals and families. These subsidies, applied through premium tax credits based on income eligibility requirements set forth by the ACA, significantly reduce monthly costs for many Americans.

Income Eligibility Requirements for Subsidies

To qualify for these financial assistance programs, applicants must meet certain income eligibility requirements. Applicants who have an annual household income within 100-400% of the federal poverty level are eligible to receive premium tax credits. Additionally, those earning up to 250% of the federal poverty level may also be eligible for cost-sharing reductions which can further decrease out-of-pocket expenses associated with their chosen health insurance plan.

Tax Credits Application Process

If you believe you might qualify for a subsidy under Obamacare, it is important to apply during your state’s designated Open Enrollment Period or Special Enrollment Period if applicable. Providing data concerning the number of people in your household and projected yearly earnings is often needed to evaluate if you can receive any form of financial help.

Government subsidies can greatly reduce the cost of monthly premiums for those who qualify, making Obama Care more accessible to families and individuals. Having discussed the benefits of government subsidies, let us now consider how other factors influence non-subsidized health insurance costs.

Obamacare and Undocumented Immigrants

Undocumented immigrants cannot enroll themselves directly into Obamacare, but they can apply for healthcare coverage on behalf of another documented individual or qualify for a Special Enrollment Period under specific circumstances outlined by law. Let’s explore these options in more detail.

Applying for Coverage on Behalf of Documented Individuals

If an undocumented immigrant has family members who are U.S. citizens or have legal immigration status, they may apply for health insurance coverage through the Health Insurance Marketplace on their behalf. This allows eligible family members to receive affordable care act benefits such as premium tax credits and cost-sharing reductions, which can help lower out-of-pocket costs associated with healthcare services.

Qualifying Circumstances for Special Enrollment Periods

- Pregnancy: Pregnant women may be eligible to enroll in Medicaid if their income is below certain limits set by the state where they reside.

- Newborn children: If a child is born to an undocumented parent while living in the United States, that child automatically becomes a U.S. citizen and qualifies for health insurance coverage under Obamacare.

- Victim of domestic violence: If an undocumented person experiences domestic violence, sexual assault, or stalking, they may be able to access emergency medical assistance programs provided by some states.

- Certain humanitarian situations: In cases like human trafficking victims or those granted temporary protected status, individuals may qualify for a Special Enrollment Period to obtain health coverage.

It is essential for undocumented immigrants to investigate these possibilities and guarantee their relatives have access to healthcare services when required.

Undocumented immigrants are ineligible for the ACA, but other potential solutions may exist. For those who have lost employer-sponsored healthcare due to job loss or other circumstances, Medicaid and premium tax credits through state marketplace exchanges can provide some assistance in obtaining health insurance.

Losing Employer-Sponsored Healthcare Coverage Options

If someone loses their job while enrolled in an employer-sponsored healthcare plan, they have options such as enrolling in Medicaid or obtaining Premium Tax Credits from their respective state’s marketplace exchange. Let’s explore these alternatives to ensure continued health coverage.

Enrolling in Medicaid after Job Loss

One option for those who lose employer-sponsored health insurance is to enroll in the expanded Medicaid program, which provides low-cost or free healthcare services to eligible individuals and families. State eligibility criteria for Medicaid typically consider factors such as income level, household size, and disability status. It is essential to check your state’s specific requirements and apply promptly after losing your job-based coverage.

Obtaining Premium Tax Credits through State Marketplace Exchanges

An alternative option for maintaining health insurance after a job loss is purchasing a plan through the state marketplace exchanges. Those with incomes below certain thresholds may qualify for premium tax credits that can significantly reduce monthly premiums. To determine eligibility and access these subsidies, you must submit an application on the marketplace website during either the Open Enrollment Period or a Special Enrollment Period triggered by qualifying life events such as job loss.

Recent Legislative Changes Impacting ACA Costs

In recent years, new federal legislation like the American Rescue Plan Act and other healthcare policies have been introduced to improve the overall accessibility and affordability of care services nationwide. These changes impact funding allocation among various aspects related to the provision of care services across the country, including mental health treatment facilities and substance abuse counseling centers.

Implications of Trumpcare on Health Insurance Costs

The introduction of Trumpcare led to several changes in the health insurance landscape, such as the elimination of cost-sharing reductions (CSRs) for insurers. This change resulted in higher premiums for some individuals who do not qualify for premium tax credits under Obamacare. Conversely, plans with higher deductibles and out-of-pocket maximums largely avoided the premium hikes caused by Trumpcare.

Effects of the American Rescue Plan Act on ACA Subsidies

- Increased Premium Tax Credits: The American Rescue Plan Act significantly increased premium tax credits available through state marketplace exchanges, making health coverage more affordable for millions of Americans during the COVID-19 pandemic.

- No Cap on Income Eligibility: Previously, households earning over 400% Federal Poverty Level (FPL) did not qualify for subsidies; however, this cap was removed by the legislation ensuring all eligible families can receive financial assistance based on their income levels.

- COBRA Coverage Support: The act also provides temporary financial assistance for individuals who lost their jobs and need to maintain their employer-sponsored health insurance through COBRA.

Estimating Expected Healthcare Costs and Choosing Plans Wisely

When choosing a healthcare plan under Obamacare, it is crucial to estimate how much does Obamacare cost per month and select the most appropriate level of coverage accordingly. This will ensure that you receive comprehensive protection against potential medical expenses incurred throughout the duration of your policy term.

Factors to Consider When Estimating Healthcare Costs

- Age: Older individuals generally have higher healthcare costs due to an increased likelihood of chronic conditions or age-related health issues.

- Health status: Pre-existing conditions, lifestyle habits (e.g., smoking), and family history can impact your overall healthcare needs and associated costs.

- Frequency of doctor visits: If you visit doctors frequently for check-ups or ongoing treatments, consider a plan with lower copayments or coinsurance rates.

- Potential major medical events: Pregnancy, surgeries, or other significant health events should be factored into your cost estimates when selecting a plan.

Utilizing Online Tools for Plan Selection

By utilizing the Health Insurance Marketplace’s comparison tool, individuals and families can quickly determine which plan best fits their budget and needs. By entering personal information like income levels, zip code location, and desired coverage type, users are provided tailored list options available within the area meeting specific criteria set forth during the initial search query submission process.

Conclusion

Determining how much does Obamacare cost per month may differ contingent on various components, such as area, income, and plan type. The average monthly premiums for health insurance plans range from $200 to $500 per person or more for family plans, however, government subsidies like premium tax credits and cost-sharing reductions can help lower costs for eligible individuals. To make an informed decision about your healthcare coverage options under the ACA, familiarize yourself with plan tiers and their associated out-of-pocket costs, as well as special enrollment periods and Medicaid expansion.