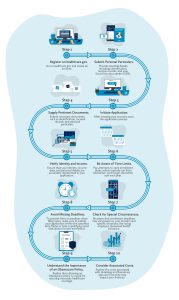

Navigating how to apply for Obama Care 2023 may feel overwhelming, yet with proper instruction and comprehension of the steps involved, it can be a much smoother endeavor. In this comprehensive blog post, we will provide you with all the necessary information on how to apply for Obama Care 2023.

We’ll begin by explaining the importance of applying during the Open Enrollment Period and highlighting state-specific enrollment deadlines. Next, we’ll discuss gathering essential documentation such as proof of income requirements and immigration documents.

Furthermore, we will guide you through navigating HealthCare.gov, creating an account on federal or state marketplaces, and completing your application form online. Once that is done, we will help you review plan options and categories so that you can make an informed decision when choosing your health insurance plan.

Finally, after enrolling in your chosen plan and finalizing enrollment procedures, we will explore Special Enrollment Period opportunities related to qualifying life events. This detailed guide aims to simplify how to apply for Obama Care 2023 while empowering families and individuals seeking affordable healthcare coverage solutions tailored to their needs.

Table of Contents

- Understanding the Open Enrollment Period

- Importance of Applying During the Open Enrollment Period

- State-Specific Enrollment Deadlines

- Gathering Necessary Documentation

- Completing Your Application Form Online

- Reviewing Plan Options and Categories

- Choosing Your Health Insurance Plan

- Enrolling in Your Chosen Plan

- Finalizing Enrollment and Receiving Confirmation

- Special Enrollment Period Opportunities

- Conclusion

Understanding the Open Enrollment Period

The Open Enrollment Period is a crucial time frame for individuals and families to apply for Obama Care. It typically starts on November 1st and ends on December 15th each year.

Some states may have extended deadlines, so it’s essential to be aware of your state’s specific timeline. During this period, anyone can sign up or change their existing plan through HealthCare.gov or their state’s exchange platform.

Importance of Applying During the Open Enrollment Period

If you miss the Open Enrollment deadline, you might not be able to obtain coverage until the following year, unless you qualify for a Special Enrollment Period due to certain life events. Applying during this window ensures that you get access to affordable health insurance options as mandated by the Affordable Care Act (ACA).

State-Specific Enrollment Deadlines

In some cases, individual states may offer an extended enrollment period beyond December 15th. For example, California residents can enroll in Covered California plans until January 31st. Comprehending the open enrollment period and its related cutoff dates are essential in “How to apply for Obama Care 2023” for capitalizing on all possible selections.

How to apply for Obama Care 2023: Get Started

-

Save

To begin your journey on how to apply for Obama Care 2023, visit HealthCare.gov. You will be directed to your state’s marketplace website or continue using the federal site, depending on which system your state uses. It is essential to understand the differences between federal and state marketplaces to ensure a smooth enrollment experience.

If this is your first time applying through HealthCare.gov or your state’s exchange platform, create an account by providing basic personal information such as your name, email address, password, and security question answers. Follow these tips for creating a secure account:

- Choose a strong password with at least eight characters, including uppercase letters, lowercase letters, numbers, and special symbols.

- Avoid using easily guessable information such as birthdates or common words as part of your password.

- Keep track of your login credentials in a safe place to prevent unauthorized access to sensitive health insurance data.

Once you have successfully created an account on HealthCare.gov or your state’s marketplace website, log in to start exploring available health coverage options under Obama Care Insurance for 2023.

Learning how to apply for Obama Care 2023 can seem intimidating, but with the proper direction, it doesn’t have to be so daunting. Having acquired the requisite information to set up your account, let us now progress toward filling out the online application form.

Completing Your Application Form Online

Once logged in, you’ll encounter the online application form which requires details such as household size, income, insurance coverage, and other elements to determine eligibility for financial aid. This form asks detailed questions regarding your household size, income, current insurance status, and other factors that determine eligibility for financial assistance.

To maximize your chances of qualifying for subsidies to lower premium costs and copayments, it’s essential to fill out this form accurately using the necessary details from the gathered documentation. To help guide you through this process, follow these steps:

- Estimate your expected income by considering all sources such as wages or self-employment earnings.

- List all family members who need coverage along with their Social Security numbers.

- If applicable, provide information about any employer-sponsored health plans available to your household members.

- For non-U.S citizens but legally residing within the country, include relevant immigration documents like a green card or visa number in the appropriate section of the application.

Taking the time now to ensure accuracy in filling out these sections can save potential headaches later on during enrollment.

Submitting your application form online is a quick and easy process that can be done in just a few simple steps. Now, let’s take a look at reviewing plan options and categories to find the best Obama Care insurance policy for you.

Reviewing Plan Options and Categories

After submitting your application, you will be presented with a list of health insurance plans available in your area that meet ACA requirements. These plans are divided into four categories – Bronze, Silver, Gold, and Platinum – based on the percentage of healthcare costs they cover.

Overview of Bronze, Silver, Gold, and Platinum plan categories

- Bronze: Covers approximately 60% of healthcare costs; lower monthly premiums but higher out-of-pocket expenses.

- Silver: Covers around 70% of healthcare costs; moderate monthly premiums with moderate out-of-pocket expenses.

- Gold: Covers about 80% of healthcare costs; higher monthly premiums but lower out-of-pocket expenses compared to Bronze or Silver plans.

- Platinum: Covers roughly 90% of healthcare costs; highest monthly premiums but lowest out-of-pocket expenses among all categories.

Choosing Your Health Insurance Plan

When comparing the available health insurance options, it’s important to consider several factors that will help you select the best plan for your family’s needs. These include:

- Monthly premium cost: Determine how much you can afford to pay each month for health insurance coverage.

- Out-of-pocket expenses: Consider deductibles, copayments, and other costs not covered by your plan when calculating overall healthcare expenses.

- Network providers: Ensure that your preferred doctors and hospitals are included in the plan’s network of providers. To find out if a certain provider is part of the plan’s network, you can usually check online or contact customer service.

- Additional benefits: Look for any extra services or perks offered by each plan, such as dental coverage, vision care, or wellness programs.

To make an informed decision, take the time to thoroughly assess each plan’s offerings and determine which best meets your needs. Remember that choosing a suitable health insurance plan ensures optimal coverage throughout the year while minimizing financial burdens associated with unexpected illnesses or injuries.

Enrolling in Your Chosen Plan

Once you have determined which health insurance plan suits your needs, it is time to get the relevant people enrolled. To begin the enrollment process, follow the prompts on HealthCare.gov or your state’s exchange platform.

You may need to provide further documentation during this step if requested by the insurer or marketplace officials. Keep all paperwork handy to ensure a smooth enrollment process is completed without delays or denials due to missing information. Some examples of additional documents that might be required include:

- Proof of residency (e.g., utility bill).

- Copies of immigration documents (if applicable).

- Social Security cards for all family members enrolling.

Finalizing Enrollment and Receiving Confirmation

To finalize the enrollment process, you’ll typically be required to pay the initial month’s premium directly through the online portal using payment methods such as credit cards, e-checks, etc., or arrange a payment method with your insurer separately depending on specific instructions given during the sign-up process.

Once your payment is processed, you will receive confirmation via email along with details regarding when coverage begins (usually January 1st of the following year), policy number, and how to access digital/printable versions of identification cards for use at doctor appointments and prescription pickups.

Special Enrollment Period Opportunities

In these cases, you have a limited window of time to apply after the qualifying event occurs to ensure continuous protection throughout the year without facing penalties for lack of insurance under the ACA mandate.

Qualifying Life Events for a Special Enrollment Period

- Marriage.

- Birth or adoption of a child.

- Moving to another state or county with different health plan options.

- Losing job-based coverage (e.g., through termination or reduction in hours).

Timeframes and Deadlines Associated with the Special Enrollment Period

The window for applying during a Special Enrollment period typically lasts for 60 days from the date of your qualifying life event. It’s important not to delay submitting your application since missing this deadline may result in being unable to obtain coverage until next year’s Open Enrollment period.

Conclusion

Learning how to apply for Obama Care 2023 requires a clear understanding of the open enrollment period and gathering all necessary documentation. It also involves navigating HealthCare.gov or state exchanges, completing an application form online, reviewing and selecting a health insurance plan, enrolling in your chosen plan, and knowing your eligibility for special enrollment periods. By following these steps carefully and providing accurate information throughout the process, families and individuals can obtain quality healthcare coverage through Obama Care in 2023.