When considering health insurance options, it’s essential to understand what does short term health insurance cover. These plans can be a viable alternative for some individuals and families seeking temporary coverage; however, they differ significantly from traditional policies.

In this blog post, we will examine what does short term health insurance cover compared to ACA-approved plans, its coverage including emergency care services and prescription drug availability, as well as affordability aspects when compared with traditional policies. We’ll also discuss the coverage provided by these policies such as emergency care services and prescription drug availability.

Furthermore, we’ll explore affordability aspects when comparing short-term policies with ACA-compliant alternatives and factors that influence premium costs. Lastly, we will examine federal regulations impacting these policies alongside state-specific regulations on what does short term health insurance cover.

Table Of Contents:

- The Basics of Short-Term Health Insurance

- Duration and Limitations of Short-Term Health Insurance

- Comparison with Obamacare-Approved Plans

- What does Short Term Health Insurance Cover

- Federal Regulations Impacting Short-Term Policies

- State-Specific Regulations on Short-Term Health Insurance

- Consumer Disclosures and Limitations

- Coverage Details and Family Options

- Conclusion

The Basics of Short-Term Health Insurance

Short-term health insurance is an affordable option for individuals and families requiring coverage during transitional periods. These plans provide limited coverage, typically ranging from one month to three years, making them ideal for those experiencing gaps in their healthcare coverage. However, they do not offer the same level of benefits as Obamacare-approved plans.Duration and Limitations of Short-Term Health Insurance

- Most short-term plans last between 30 days and 12 months.

- Policies can be renewed up to a maximum duration of three years.

- Coverage may be more limited than traditional health insurance policies.

Most plans start at around 30 days and have a maximum of 364 days per term

-

Save

Comparison with Obamacare-Approved Plans

In contrast to short-term health insurance, ACA-compliant plans are mandated by law to provide coverage for essential benefits such as maternity care, mental health services, and preventive care without the possibility of denying applicants based on pre-existing conditions or charging higher premiums due to an individual’s medical history. Furthermore, these comprehensive policies are prohibited from denying coverage or charging higher premiums based on medical history. Short-term health insurance may be a cost-efficient substitute to conventional healthcare plans, however, it is essential to recognize the duration and restrictions related to these policies. Moving on, let’s take a look at what does short term health insurance cover.Get informed about short-term health insurance. While affordable, it may not offer the same benefits as Obamacare-approved plans. #healthinsurance #Obamacare Click to Tweet

What does Short Term Health Insurance Cover

Short-term health insurance primarily focuses on emergency care services and can be a suitable choice for those needing coverage during transitional periods. Short-term health insurance policies may not guarantee the 10 essential health benefits mandated by the ACA, and they often exclude pre-existing medical conditions.- Emergency care services covered: These plans typically cover hospitalization, emergency room visits, and surgeries related to unforeseen accidents or illnesses.

- Prescription drug and mental health treatment availability: While many short-term policies offer prescription drug coverage, they may be limited in scope. Additionally, some plans provide outpatient mental health care with restrictions on duration and cost-sharing.

Short-term health insurance covers emergency care services, prescription drugs & some outpatient mental health treatment. It’s a temporary solution for healthcare coverage gaps. #healthinsurance #Obamacare Click to Tweet

Affordability vs ACA-Compliant Plans

One key advantage of short-term health insurance is its affordability compared to ACA-compliant plans. With premiums often costing less than $100 per month for individual coverage, it can be an attractive option for those between jobs or awaiting enrollment in a major medical plan due to a qualifying life event.Cost Comparison Between Short-Term Policies and ACA-Compliant Alternatives

- Premiums: Short-term plans typically have lower monthly premiums than traditional health insurance.

- Deductibles: While deductibles may be higher with short-term coverage, they are still generally more affordable overall.

- Coverage Limitations: It’s important to note that the lower cost comes with limited benefits and exclusions, such as pre-existing conditions and essential health benefits.

Factors Influencing Premium Costs

The cost of short-term health insurance depends on factors like age, location, policy duration, and chosen deductible. Additionally, these plans do not qualify for premium subsidies under the Affordable Care Act (ACA), which could impact affordability for some individuals seeking temporary coverage options during transitional periods in their lives. Weighing the financial differences between what does short term health insurance cover and ACA-compliant options is a significant element to consider when picking out a health insurance policy. Moving on, it is also essential to understand how federal regulations have impacted short-term policies in recent years.Looking for affordable health insurance? Short-term plans may be the answer. With lower premiums and deductibles, it’s a great option during transitional periods. #healthinsurance #affordablecare Click to Tweet

Federal Regulations Impacting Short-Term Policies

Despite federal regulations extending the permissible length of policy duration up to three years since October 2018, short-term health insurance plans are still excluded from the definition of individual health insurance. The Tax Cuts and Jobs Act eliminated penalties associated with these types of policies, making them more appealing for those seeking affordable coverage options.- Policy duration extension: In October 2018, federal regulations allowed short-term policies to last up to three years, providing a longer coverage option for individuals in need.

- Elimination of penalties: With the Tax Cuts and Jobs Act, consumers no longer face penalties for choosing short-term insurance over ACA-compliant plans.

Need affordable health coverage during a transitional period? Short-term policies may be an option, but beware of exclusions for pre-existing conditions. #healthinsurance #Obamacare Click to Tweet

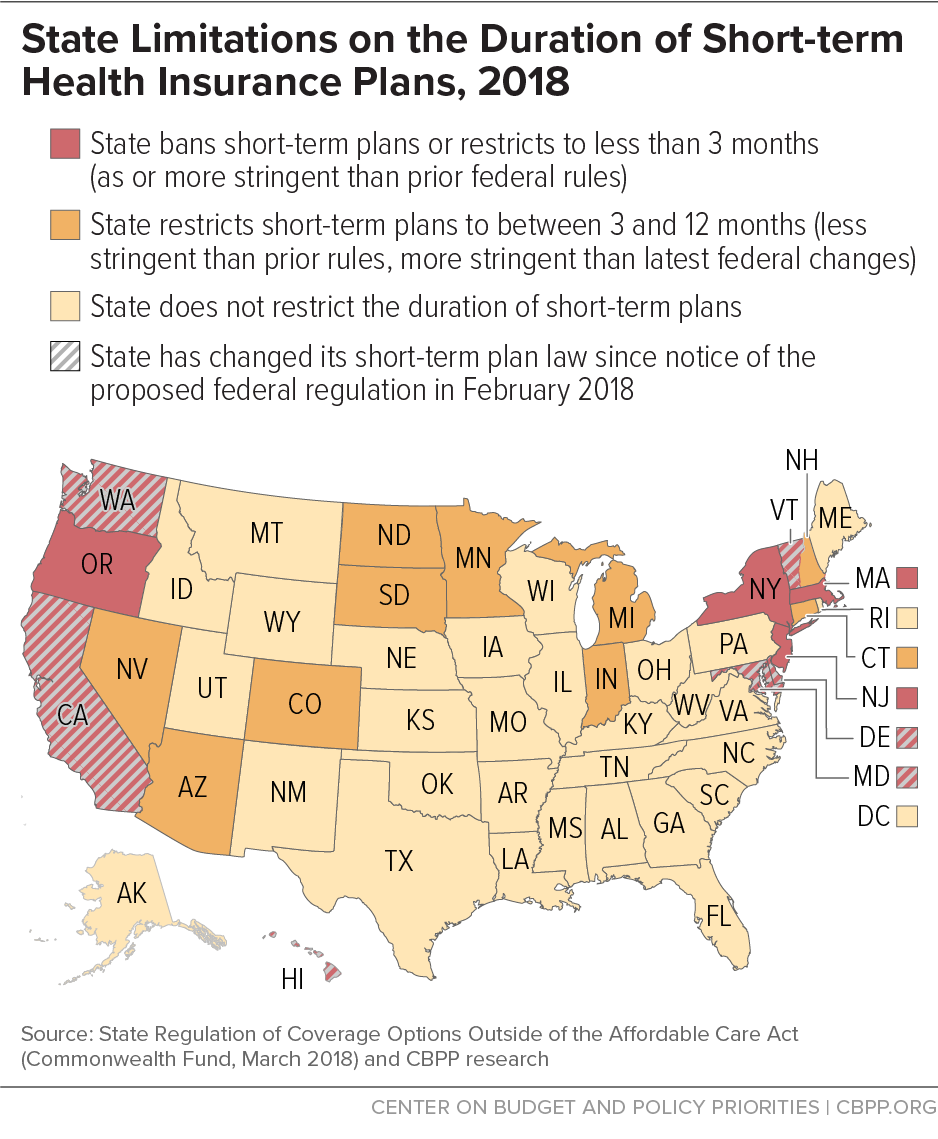

State-Specific Regulations on Short-Term Health Insurance

States retain autonomy over their own specific regulations regarding Short-Term Limited Duration Insurance (STLDI) offerings, including bans on sale altogether. As of January 2023, twelve states passed legislation prohibiting “health status” underwriting related to STLDIs; thirteen states plus Washington D.C., maintained the previous three-month limit as part of their own regulations.State-Level Restrictions and Prohibitions

- Bans: California, Hawaii, Massachusetts, New Jersey, and New York have banned short-term health insurance plans completely.

- Limited Duration: States like Colorado and Illinois restrict policy durations to six months or less.

- Rigorous Standards: Some states impose stricter consumer protection measures than federal requirements dictate.

-

Save

Importance of Consulting Licensed Agents When Considering Available Options

To gain insight into local regulations and discover the ideal coverage option for you, it is essential to consult with a certified representative who can provide direction on accessible policies in your area. This ensures that you are well-informed about any potential limitations or exclusions before committing to a plan.Get the right coverage for your needs. Consult with a licensed agent to navigate state-specific regulations on short-term health insurance. #Obamacare #HealthInsuranceCoverage Click to Tweet

Consumer Disclosures and Limitations

The National Association of Insurance Commissioners (NAIC) adopted the Supplementary and Short-Term Health Insurance Minimum Standards Model Act in 1974, which was revised in 2023 to include provisions concerning short-term health plans. These revisions emphasize requirements for consumer disclosures, ensuring that individuals are aware of any limitations associated with their chosen policies.NAIC’s Role in Regulating Short-Term Health Insurance

The NAIC plays a crucial role in setting standards for state insurance regulators to follow when overseeing short-term health insurance plans. By updating the model act, they help ensure consumers have access to transparent information about their coverage options.Emphasis on Consumer Disclosure Requirements

- Mandatory disclosure: Insurers must provide clear explanations of policy terms and conditions, including exclusions or limitations related to pre-existing conditions and essential health benefits.

- Risk awareness: Consumers should be informed about potential risks associated with choosing a short-term plan over traditional health insurance or ACA-compliant coverage.

- Contact information: Insurers must supply contact details for further assistance regarding policy inquiries or filing medical claims.

Get informed about your short-term health insurance coverage. The NAIC ensures consumer disclosures and limitations are transparent. #ObamaCare #HealthInsurance Click to Tweet

Coverage Details and Family Options

Most short-term health insurance plans cover at least one doctor’s checkup at a low cost. However, payments for doctors will vary by plan. Emergency hospital care is typically covered, but medical transportation may not be included. Services and durable medical equipment might also be covered depending on your specific policy.- Doctor visits: Coverage often includes a minimum of one visit per year.

- Emergency hospital care: Generally provided, though the extent varies between policies.

- Medical transportation exclusions: Ambulance services are frequently excluded from coverage.

Get the coverage you need with short-term health insurance. Doctor visits and emergency hospital care are usually covered, but check your policy for details. #Obamacare #healthinsurance Click to Tweet

Conclusion

What Does Short Term Health Insurance Cover? Short-term health insurance policies are designed to provide temporary coverage for individuals and families who need medical benefits for a limited period. They offer various services such as emergency care, prescription drug coverage, and outpatient mental health treatment availability, however, it is essential to understand the limitations of these policies and state-specific regulations before purchasing them. Consulting licensed agents can help you get accurate information about what your policy covers.Contact Fiorella Insurance today for your free health insurance quote.