What are the best health insurance companies in Florida? When selecting Florida health insurance providers, there are a variety of criteria to take into account. In this comprehensive guide, we will delve into the top providers and what sets them apart from their competitors.

We’ll explore some of the most reputable health insurance companies such as Blue Cross Blue Shield, Aetna, Molina Healthcare, Oscar Health Insurance, and Cigna. Each company offers unique benefits tailored to meet various needs of individuals and families seeking affordable healthcare options.

In addition to discussing what are the best health insurance companies in Florida, our analysis will cover essential aspects like buying a plan through the Marketplace during open enrollment periods and understanding eligibility requirements for premium tax credits. Furthermore, we’ll provide insights into average costs associated with different types of plans available in Florida counties.

To help you make an informed decision on what are the best health insurance companies in Florida based on your specific circumstances and preferences, we’ll also discuss HMO vs POS/PPO plans along with their respective advantages and disadvantages. Lastly, special attention will be given to coverage options for self-employed individuals as well as comparing Humana vs WellCare Medicare offerings.

Table of Contents

- What are the best health insurance companies in Florida?

- Blue Cross Blue Shield (BCBS): Comprehensive Coverage with an Extensive Network

- Aetna: Convenient Access to CVS MinuteClinic Locations Across Florida

- Molina Healthcare: Low-Cost Bronze Plans without Dental Coverage

- Oscar Health Insurance: Affordable Plans with Free Same-Day MinuteClinic Services

- Cigna: Cost-Effective Healthcare Solutions Including Online Consultations

- Buying a Plan through the Marketplace

- Average Cost of Health Insurance Plans in Florida

- HMO vs POS/PPO Plans: Understanding Your Options

- Tailoring Health Insurance to Unique Circumstances

- Conclusion

What are the best health insurance companies in Florida?

Choosing the best health insurance company in Florida can be challenging due to the numerous options available. What are the best health insurance companies in Florida? Some of the top contenders include Blue Cross Blue Shield (BCBS), Aetna, Molina Healthcare, Oscar Health Insurance, Cigna, Bright Health, Humana, and WellCare Medicare.

Blue Cross Blue Shield (BCBS): Comprehensive Coverage with an Extensive Network

As one of the largest health insurers in Florida, BCBS provides comprehensive coverage through its wide range of plan options. With an extensive network of healthcare providers, members have access to quality care throughout the state. Additionally, BCBS offers various wellness programs and resources for preventive care.

Aetna: Convenient Access to CVS MinuteClinic Locations Across Florida

Aetna is known for offering convenient access to healthcare services through its partnership with CVS Pharmacy’s MinuteClinic locations across Florida. This allows members to receive quick medical attention without needing a scheduled appointment at a doctor’s office or hospital visit.

Molina Healthcare: Low-Cost Bronze Plans without Dental Coverage

If you’re seeking an economical health insurance option without dental coverage, Molina Healthcare may be the ideal selection. They offer affordable bronze plans that provide essential benefits such as hospitalization, prescription drugs, and maternity care. However, these plans do not include dental coverage.

Oscar Health Insurance: Affordable Plans with Free Same-Day MinuteClinic Services

Oscar Health Insurance is another affordable option for Florida residents seeking quality healthcare at a lower cost. Their plans offer free same-day access to CVS MinuteClinic services and telemedicine consultations through their app or website.

Cigna: Cost-Effective Healthcare Solutions Including Online Consultations

For those looking for cost-effective health insurance options in Florida, Cigna offers various plan choices that cater to different budgets and needs. One of the benefits of choosing Cigna is their focus on providing convenient access to healthcare services such as online doctor consultations via video calls or messaging platforms.

Buying a Plan through the Marketplace

When it comes to purchasing health insurance in Florida, residents can take advantage of the open enrollment periods to buy plans through healthcare.gov, also known as the Marketplace. This platform allows individuals and families to compare various providers’ offerings based on their specific needs and budgets. If you qualify for a premium tax credit, you can receive advance payments that cover some or all of your health insurance premiums each month.

Open Enrollment Periods for Purchasing Obamacare Insurance in Florida

The open enrollment period is an annual window during which eligible individuals can enroll in a new plan or make changes to their existing coverage. In Florida, the open enrollment window typically begins on November 1st and closes on December 15th annually. Outside the typical November 1st to December 15th open enrollment period, certain life events such as job loss or childbirth may qualify you for a special enrollment period (SEP).

Premium Tax Credits Eligibility Requirements

- Your household income must fall between 100% and 400% of the federal poverty level (FPL).

- You cannot be claimed as someone else’s dependent on their tax return.

- You are not eligible for other types of minimum essential coverage like Medicaid or employer-sponsored insurance.

- If married filing jointly, both spouses must apply together unless they meet specific criteria outlined by healthcare.gov.

To ensure compliance with the ACA, it’s necessary to purchase health insurance coverage through the Marketplace. By doing so, you can rest assured that your chosen plan will provide comprehensive benefits and protections as mandated by law.

When selecting what are the best health insurance companies in Florida, remember to consider factors such as affordability, network size, and additional services offered. It’s important to compare plans during open enrollment in order to make an informed decision that meets your individual needs.

Average Cost of Health Insurance Plans in Florida

In Florida, the average cost of health insurance stands at $554 per month for a 40-year-old individual. However, prices may vary depending on factors such as age group, coverage preferences, and overall medical history. It’s crucial to compare different providers’ offerings based on specific requirements like affordability or comprehensive coverage levels desired by families or individuals looking into obtaining Obama Care Insurance within the state.

Factors Affecting Monthly Premium Costs

- Age: As you get older, your health insurance premiums typically increase due to higher risks associated with aging.

- Tobacco use: Smokers often pay more for their health insurance plans because they are considered high-risk customers by insurers. Quitting smoking can help lower your premium costs significantly.

- Location: The cost of living and healthcare services varies across different regions in Florida; hence it impacts the pricing of health insurance plans accordingly.

- Coverage level: Comprehensive plans that cover a wide range of services usually come with higher monthly premiums compared to basic ones offering limited benefits.

Comparing Providers Based on Personal Needs

To know what are the best health insurance companies in Florida with an affordable yet suitable plan tailored to your needs, start by comparing quotes from multiple companies using online tools like those available at HealthCare.gov. Consider aspects such as deductibles, copayments/coinsurance amounts, and out-of-pocket maximums while evaluating various options.

Additionally, take note of any extra perks offered by certain providers – these could include gym membership discounts or access to telemedicine consultations, which might be valuable additions worth considering when making a final decision.

HMO vs POS/PPO Plans: Understanding Your Options

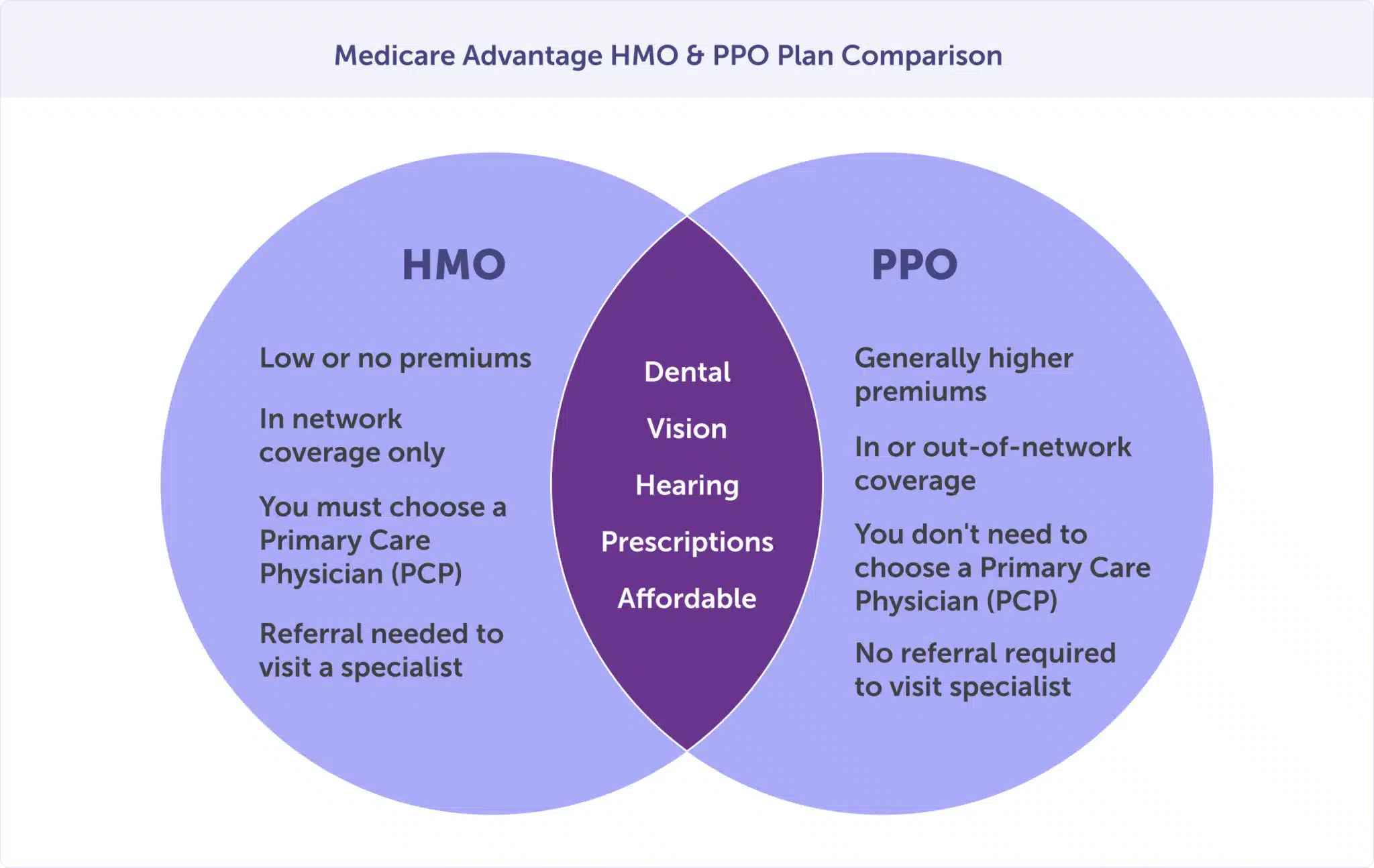

Deciding on a health insurance provider in Florida requires an understanding of the differences between plan types, such as HMO and POS/PPO. Humana offers several HMO plans and four POS/PPO plans, making them suitable for different preferences depending on your overall health status and specific needs.

Advantages and Disadvantages of HMO Plans

- Lower costs: HMOs typically have lower monthly premiums compared to other plan types. They may also have reduced expenses, like copays or deductibles, that you need to pay.

- Simplified process: With an HMO plan, you generally only need referrals from your primary care physician (PCP) for specialist visits or additional services. This can simplify the healthcare process by reducing paperwork.

- Narrow network: One major drawback of an HMO is that they usually require you to choose providers within their network. If you prefer seeing a particular doctor who isn’t part of the network, you may not be covered for those visits.

Benefits and Drawbacks of POS/PPO Plans

Unlike with an HMO plan where there are strict limitations regarding which doctors can be visited without incurring extra charges, PPO/POS policies allow more flexibility when selecting medical professionals since these networks often include a wider range of specialists than what might otherwise be available through traditional HMOs.

It is imperative to be aware of the pros and cons of HMOs as well as the benefits and disadvantages of POS/PPO plans when it comes to comprehending your health insurance selections.

Tailoring Health Insurance to Unique Circumstances

For self-employed individuals seeking indemnity health insurance plans specifically tailored towards their unique circumstances, both Humana and WellCare Medicare can offer viable alternatives worth exploring further based on individual requirements such as budget constraints or specific medical needs. It is crucial to ensure that your chosen plan meets all your healthcare needs while staying within your financial limits.

Evaluating Coverage Options for Self-Employed Individuals

To find the best fit for your situation, start by assessing the following factors:

- Budget: Determine how much you can afford to spend on monthly premiums and out-of-pocket expenses like copayments, deductibles, and coinsurance.

- Coverage Level: Decide whether you need comprehensive coverage with a higher premium or a more affordable plan with limited benefits.

- Network Access: Check if the provider’s network includes doctors and hospitals in your area. This will help avoid high out-of-network costs when seeking care from preferred providers.

- Savings Opportunities: Look for discounts offered through wellness programs or consider joining a professional association that provides group rates on health insurance policies.

Comparing Humana vs WellCare Medicare

In addition to evaluating the general factors mentioned above, compare these two popular providers’ offerings side-by-side before making a decision. Here are some key aspects of each company’s plans that may influence your choice:

- Humana: Offers a wide range of health insurance plans, including affordable health insurance options. They have a large network of healthcare providers and offer wellness programs to help members stay healthy.

- WellCare Medicare: Specializes in Medicare plans and offers a variety of options to fit different budgets and healthcare needs. They have a strong focus on customer service and offer prescription drug coverage.

Taking the time to compare both providers’ offerings based on your unique circumstances will ensure that you make an informed decision when choosing a health insurance provider that meets all your healthcare needs within budget constraints.

Conclusion

When it comes to “What are the best health insurance companies in Florida?”, it is always recommended to compare factors such as affordability, network size, and additional services offered. When comparing providers based on personal needs, consider factors affecting monthly premium costs. By assessing individual needs and financial capabilities before choosing a health insurance plan in Florida, individuals can make an informed decision on which company best suits their unique circumstances.