Who pays health insurance while on short term disability?

This question is a maze that often leaves people feeling lost when they are suddenly unable to work. It’s as if you’re thrown into an unfamiliar labyrinth without any guidance, and it can be quite frightening.

You’re already dealing with the stress of your illness or injury, and now you have to figure out who pays health insurance while on short term disability during this period.

And let me tell you, navigating through these murky waters isn’t easy! The fear that one wrong move could lead to financial ruin is real. It can be daunting to contemplate the potential consequences of a misstep, with no assurance of any security in the end.

But here’s some truth: understanding “who pays health insurance while on short-term disability”, can make all the difference between sinking or swimming in these uncharted territories.

Table of Contents

- Understanding Short-Term Disability Insurance

- Starting Short-Term Disability Benefits

- Duration of Short-Term Disability Benefits

- Comparing Short-Term vs Long-Term Disability Insurance

- Employer Costs for Providing Disability Insurance

- Health Insurance Coverage During FMLA Leave

- Employer Recovery of Health Insurance Premiums

- FAQs in Relation to Who Pays Health Insurance While on Short Term Disability

- Conclusion

Understanding Short-Term Disability Insurance

Let’s explore the world of short-term disability insurance.

This income replacement benefit provides a percentage of your pre-disability earnings on a weekly basis. It’s designed to cover off-the-job accidents and illnesses that workers’ compensation doesn’t handle.

Wage Replacements and Partial Disability Benefits

The wage replacements for short-term disability can range from 40% to 70%. Some policies even have a monthly benefit maximum.

Here’s an interesting fact: Employees who are only partially disabled may still be able to work part-time while receiving benefits. In some cases, they could receive up to 100% of their pre-disability earnings.

Rehabilitation Services and Common Reasons for Claims

In addition to financial assistance, certain short-term disability policies provide rehabilitation services too, including who pays health insurance while on short term disability. This means employees can partner with vocational rehabilitation counselors, creating effective return-to-work plans after medical leave or unpaid leave due to incidents like injuries or serious health conditions.

Pregnancy/maternity leaves also often fall under the umbrella of common reasons for filing a short-term disability claim. To ensure comprehensive coverage during such times, we must understand how these benefits start, which will be discussed next.

Employees need to be aware of the specific details of their short-term disability policies to make informed decisions and access all available resources for support during challenging periods.

Starting Short-Term Disability Benefits

Timing is essential when beginning short-term disability benefits. The start of these benefits can vary depending on the specifics of your insurance policy and the nature of your medical condition.

Accidents vs Illnesses: When Do Benefits Start?

In most cases, if you’re injured in an accident, short-term disability benefits start from day one. However, for illnesses or non-accidental injuries like back pain or stress-related conditions; there’s usually a waiting period before you begin receiving payments. This delay often starts after the eighth day following filing a short-term disability claim.

Variations Depending On Specific Circumstances

Certain factors can affect when your short-term disability insurance work begins paying out, including who pays health insurance while on short term disability.

For instance, job-protected leave under legislation such as Family Medical Leave Act (FMLA) may impact this timeline. Also noteworthy are specific rules around certain medical conditions that might have different stipulations within various policies.

Understanding these details is crucial for employees to know when to expect coverage to kick in and what conditions might be covered under their short-term disability insurance. Being well-informed about these factors empowers individuals to navigate the process more effectively during times of medical leave.

Pregnancy and Maternity Leave Considerations

If we consider pregnancy as an example – many plans treat normal pregnancies as any other illness with regards to benefit periods which typically commence eight days post-delivery unless complications arise earlier requiring time off work prior to delivery.

This illustrates how unique circumstances could influence when exactly workers’ compensation, or more accurately stated – ‘disabilities act’, commences payment distributions. Remember though every plan differs so always consult with HR representatives about details pertaining specifically to individualized coverage agreements.

Duration of Short-Term Disability Benefits

The span of short-term disability benefits can vary significantly depending on the provider and policy specifics. Typically, providers offer periods such as 13 weeks, 26 weeks, or even up to a full year (52 weeks). This flexibility allows for the accommodation of different medical conditions that may require varying lengths of time off work.

Determining Benefit Duration

Your benefit duration is often determined by your specific social security disability insurance. In some cases, it’s also influenced by state regulations surrounding workers’ compensation and job-protected leave under acts like the Family Medical Leave Act (FMLA).

Moving from Short-Term to Long-Term Coverage

If an employee’s income continues to be affected due to ongoing health issues beyond their short-term coverage period, they might need long-term disability plans to receive benefits, including who pays health insurance while on short term disability.

The transition between these two types involves filing another claim to receive benefits. Once approved for long-term coverage, this ensures continued financial support while dealing with debilitating illnesses or injuries. Understanding the process of filing for long-term disability and receiving benefits can provide essential financial stability during challenging times and help individuals better manage their healthcare needs.

This section has provided insight into how short-term disability insurance works in terms of duration and receiving benefits. Next, we will explore how this differs when comparing it with its counterpart – long-term disability insurance, as well as workers’ compensation.

Understanding the distinctions between short-term and long-term disability insurance, as well as workers’ compensation, can help individuals plan for the future and ensure they have the appropriate coverage in place based on their unique needs and circumstances. Being aware of the specific benefits and limitations of each type of coverage can empower individuals to make informed decisions about their financial and healthcare security during times of illness or injury.

Comparing Short-Term vs Long-Term Disability Insurance

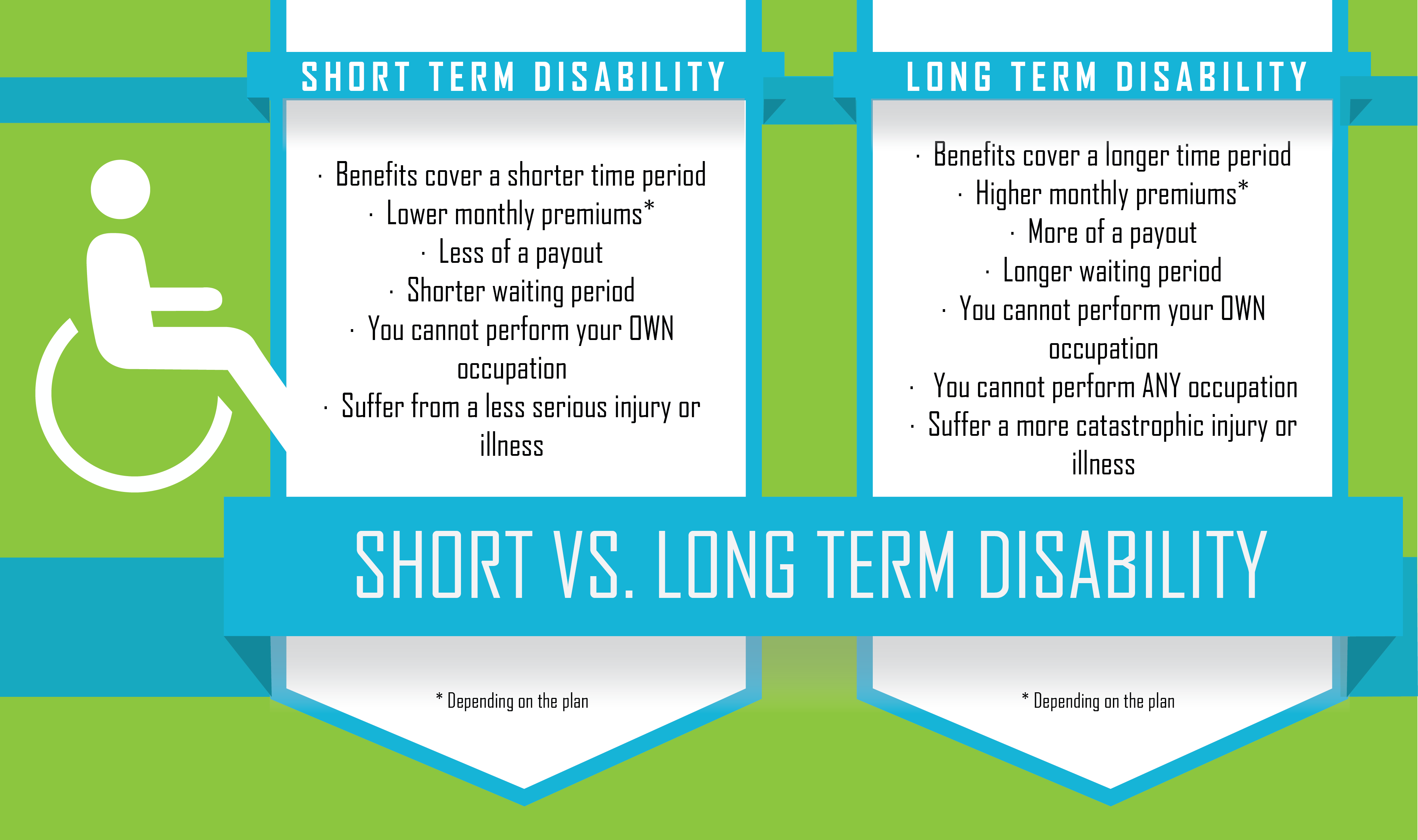

The distinction between short-term and long-term disability insurance, including who pays health insurance while on short term disability, is critical to understand.

These two types of policies serve different purposes, have varying benefit periods, and are designed for distinct medical conditions or disabilities act implications. Understanding the differences between short-term and long-term disability insurance can help individuals make well-informed choices when selecting their coverage options.

Difference in Benefit Periods

In general, short-term disability benefits start immediately after an accident or within a week following the onset of illness. They typically last up to 52 weeks at most.

This contrasts with long-term disability plans, which kick in when your short term coverage ends but can continue providing income replacement for several years – even until retirement age according to the U.S Bureau of Labor Statistics.

Variation in Payout Structure

An essential difference lies in how these employee benefits are paid out. While you receive weekly checks under short-term disability policies, long-term ones pay monthly installments – ensuring continuous support during prolonged absences from work due to severe health issues or accidents that prevent employees from performing their job duties effectively.

Premium Payments and Coverage Details

Your premium payments will also differ based on whether you opt for a short- versus long-term disability claim plan, which provides coverage. Typically, employers provide some level of both coverages as part of their comprehensive employee income protection strategy; however, details vary widely across companies depending upon factors like industry norms, company size, etc. so it’s always best practice to research thoroughly before making any decisions regarding personal financial security planning efforts.

Understanding the coverage options available and the associated costs can help individuals select the most suitable disability insurance plan that aligns with their specific needs and budget constraints.

Employer Costs for Providing Disability Insurance

In the realm of employee benefits, disability insurance is a significant consideration. The cost to employers can be substantial but necessary in providing short-term and long-term disability plans. provide insight into these costs.

The average expenditure per full-time worker amounts to approximately $624 annually – that’s about 1% of total compensation cost.

Navigating Premium Payments and Benefit Payouts

This figure includes both premium payments made by employers towards policies as well as any benefit payouts under those policies when employees file a valid short-term or long-term disability claim.

Policies are designed not only to replace an employee’s income during periods they cannot work due to medical conditions, but also often include rehabilitation services aimed at returning them back into the workforce more quickly.

Balancing Cost with Employee Welfare

An employer’s willingness to shoulder such costs underscores their commitment towards ensuring job-protected leave for workers facing health challenges without compromising financial stability.

In our next section, we’ll delve deeper into how health insurance coverage continues even while on Family Medical Leave Act (FMLA) approved leaves.

Health Insurance Coverage During FMLA Leave

The Family Medical Leave Act (FMLA) is a critical piece of legislation that protects employees’ jobs during extended medical leave. This act obligates employers to continue providing health insurance coverage for up to 12 weeks while an employee is on approved FMLA leave.

COBRA Coverage After FMLA Leave Period

In some circumstances, the requirement for medical leave might be greater than the 12 weeks allowed by FMLA. If this happens, employees are entitled to maintain their healthcare benefits under COBRA – Consolidated Omnibus Budget Reconciliation Act.

Employer Recovery of Health Insurance Premiums

In certain situations, employers may be able to recover group health insurance premium payments made during an employee’s unpaid leave under the Family Medical Leave Act (FMLA), including who pays health insurance while on short term disability. This typically happens when an employee fails to return from FMLA leave or does not work for at least thirty calendar days after returning.

It’s essential for both employers and employees to be aware of these provisions to ensure they understand their respective responsibilities and rights under the FMLA regulations.

Exceptions in Employer Recovery

However, it is important to note that there are certain circumstances where employers cannot recover these costs. If an employee’s failure to return is due to circumstances beyond their control such as serious medical conditions or other unforeseen issues, employers cannot recover these costs. This could include things like ongoing treatment requirements or complications arising from a disability claim.

The employer must also consider factors such as job-protected leave and whether the worker has been receiving benefits through short-term disability policies, including who pays health insurance while on short term disability. The rules surrounding recovery can be complex and vary depending on individual cases, so it’s crucial for both employees and employers alike to understand them fully.

For anyone with questions concerning disability plans or workers’ comp claims while on medical leave, consulting an expert in employment law may be the best way to get tailored advice.

FAQs in Relation to Who Pays Health Insurance While on Short Term Disability

Will I receive a W2 for short term disability?

If your employer pays the premiums, you’ll get a W-2. If you pay them yourself with after-tax dollars, it’s tax-free and no W-2 is issued.

Does disability income insurance pay actual medical costs?

No, disability income insurance provides wage replacement benefits if you’re unable to work due to illness or injury. It doesn’t cover medical expenses.

Which insurance provides financial protection in case of work loss due to disability?

Disability insurance offers financial protection by replacing a portion of your income if an illness or injury prevents you from working.

What type of insurance provides benefits when one is unable to work from an illness or injury?

The answer is Disability Insurance – both Short-Term and Long-Term Disability policies provide these types of benefits.

Conclusion

Short-term disability insurance is a lifesaver, covering off-the-job accidents and illnesses that workers’ compensation doesn’t touch.

It’s not just about wage replacements; it can also include rehabilitation services and even partial benefits for those who are still able to work part-time.

The start of these benefits isn’t always immediate – sometimes you have to wait until the eighth day after filing a claim. But when they kick in, they can last up to 52 weeks depending on your provider.

If you’re comparing short-term vs. long-term disability insurance, remember: while both provide income protection, their payout schedules differ significantly. Short term pays weekly; long term monthly.

Additionally, during periods of short-term disability, the question of who pays health insurance while on short term disability becomes relevant.

Your employer plays a crucial role here too. They might be footing the bill for this coverage or sharing costs with employees – an expense that averages around $624 per full-time worker annually! Understanding the details of your disability insurance coverage and the associated costs is essential for financial planning and ensuring you have the necessary support in case of unexpected health challenges.

In terms of health insurance during FMLA leave? The rules state employers must continue medical coverage as long as premium payments are made by the employee. And if you go beyond your FMLA period? COBRA has got your back with continuation coverage options.

Just beware: If you don’t return from leave or fail to put in at least thirty days’ work post-leave without valid reasons like serious health conditions…your employer could recover any group health premiums paid during unpaid portions of your leave!