Why Your Small Business Should Offer

Group Health Benefits

In an effort to recruit and retain happy employees, small businesses like yours have to consider what’s most important to workers while also keeping in mind your organization’s budgetary constraints. Thinking about group health benefits is a good place to start.

If your small business doesn’t offer group health benefits, your employees must purchase their own individual health insurance plans, or go without health coverage. Unfortunately, it has become more difficult for employed individuals to afford coverage as premiums rise to unprecedented levels in the United States.

In fact, premiums on individual coverage have gone up by 15 to 33 percent compared to last year, forcing families to choose between health insurance and basic necessities. In comparison, a recent survey by the Kaiser Family Foundation revealed that employer-sponsored plans rose by less than 5 percent in 2017.

Although businesses that employ fewer than 50 full-time equivalents aren’t required to offer group health insurance coverage under the Affordable Care Act (ACA), doing so can offer your business a number of competitive advantages.

Offering coverage improves employee retention rates

When individual health insurance premiums rise significantly, your employees will be forced to either ditch their coverage or may consider looking for work elsewhere. Small businesses that can offer affordable health plan coverage may see lower turnover rates, recruit more desirable talent and witness a spike in employee morale. In short, it is an excellent strategy to control costs.

A Fractle survey found that most job seekers would consider taking a position with lower compensation if it meant getting better health benefits. Additionally, 88 percent of survey respondents said that health insurance is a top consideration when deciding whether or not to accept a job offer.

As a small business owner, you cannot afford to lose valuable employees to competitors who offer better benefits. According to the Society For Human Resource Management, the average cost-per-hire is $4,129 – but that figure doesn’t account for everything. When you consider the missed productivity, lower engagement rates and additional training hours, it becomes clear that the damage to your company could be even more severe. In fact, a study conducted by the Center for American Progress found the cost of losing an employee could total 16 percent of the earnings for an hourly, unsalaried worker and up to 213 percent of the salary for a highly trained position.

-

Save

Call one of our group benefits experts.

(772) 283-0003

Group health insurance saves money in multiple ways

Small Business Group health insurance saves money in multiple ways. Under the Federal Insurance Contributions Act (FICA), employers pay Social Security and Medicare taxes. However, the costs of group health insurance and employer contributions to retirements are exempt from FICA taxes which is of the tax benefits you can take advantage of.

So consider this: Let’s say you have \$10,000 to spend either on employee bonuses and raises or on group health benefits. If you decide to give everyone a raise, you and your employees will have to pay additional taxes on that increased income. It may even put your employees into a higher tax bracket – which means they could actually owe the government more than they can afford. On the other hand, if you choose to invest in group health benefits, you won’t have to pay any additional taxes, the benefits are tax deductible and you’ll gain improved employee recruitment and retention rates. Your employees will appreciate your dedication to their well-being, and this perceived value will increase worker satisfaction as well.

-

Save

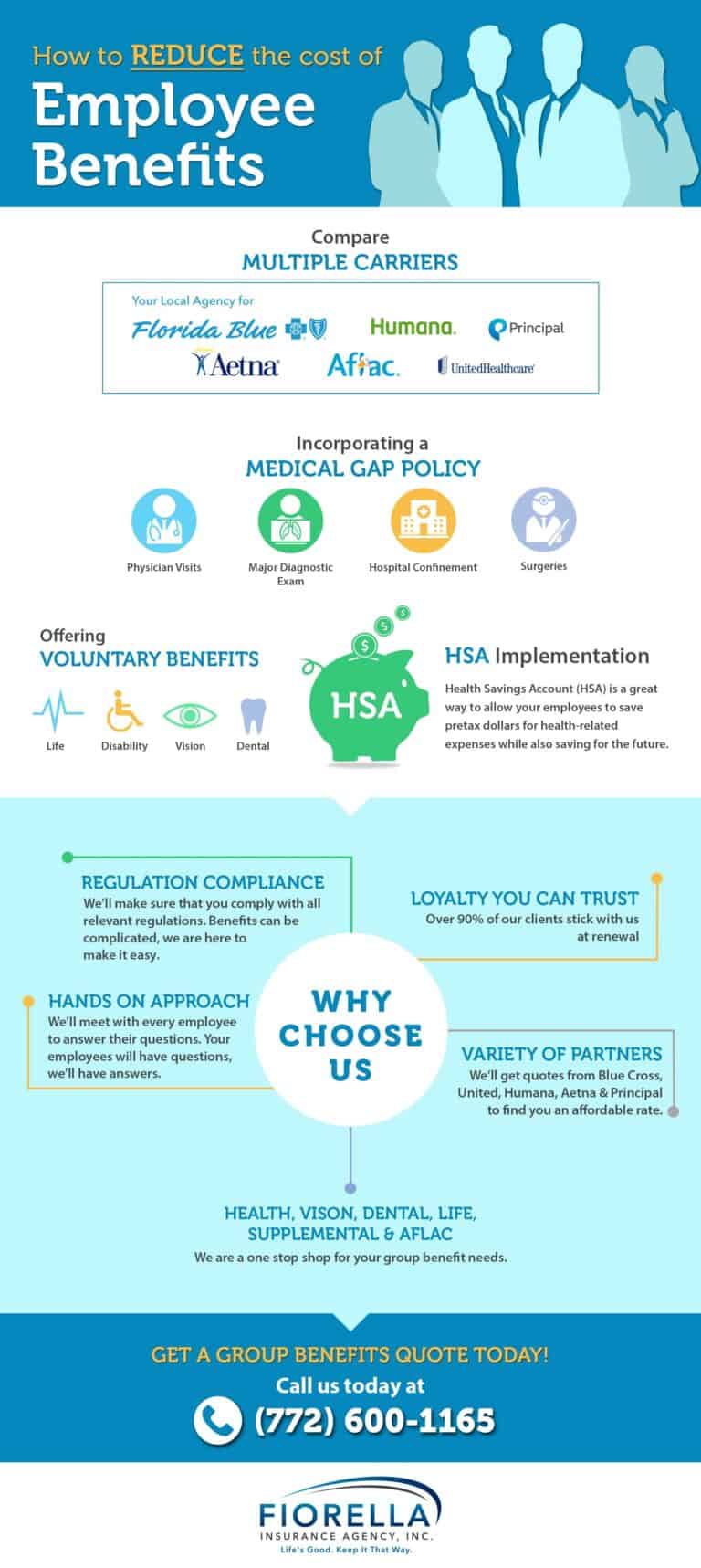

An insurance partner can find the optimal plan

If there’s one thing a small-business owner can always use, it’s more time. Sifting through the insurance marketplace, comparing plans and handling payroll changes requires a lot of effort.

Having an insurance agent is free to the business (the insurance carrier pays commission to the agent). We will save you time and resources by gathering quotes from major insurance carriers so you can focus on your business.

A dedicated insurance partner such as Fiorella will take care of the hard work by determining the most affordable plan, assisting with tax documents, and answering any questions your employees may have about their new coverage.

Get set up with employee benefits or let us lower your benefits cost by contacting us today!

-

Save