When it comes to small business health insurance, navigating the numerous options available can be a daunting task for employers and employees alike. In this comprehensive guide, we will explore various alternatives tailored specifically for small businesses, providing you with the knowledge needed to make informed decisions about your company’s healthcare coverage.

We’ll delve into traditional group health insurance plans and their pros and cons while also discussing factors that affect premiums in these plans. We’ll also investigate progressive options, like Health Reimbursement Arrangements (HRAs), such as Group Coverage HRAs, ICHRA, and QSEHRA.

Furthermore, self-insurance options will be explored along with their advantages and disadvantages. Finally, we’ll touch upon the concept of offering health stipends as a flexible alternative for owners seeking more control over small business health insurance for their employees.

Table of Contents

- Small Group Health Insurance

- Group Coverage Health Reimbursement Arrangements (HRAs)

- Qualified Small Employer Health Reimbursement Arrangement (QSEHRA)

- Self-Insurance Options

- Health Stipends as a Flexible Option

- Conclusion

Small Group Health Insurance

Under the Affordable Care Act, employers with 50 or more full-time equivalent employees must provide minimum essential coverage. Small businesses can purchase small group health insurance by paying a fixed premium to cover their employees’ healthcare needs. This option offers stability and predictability for both employers and workers.

Pros and Cons of Traditional Small Group Health Insurance

- Pros: Employees receive comprehensive coverage, pre-existing conditions are covered, premiums are tax-deductible for employers, and plans often include wellness programs.

- Cons: Premiums can be expensive for smaller companies, limited plan options may not suit every employee’s needs, and annual rate increases can be unpredictable.

Factors Affecting Premiums in Small Business Health Insurance

Premiums for small business health insurance plans depend on various factors such as the size of the company, location of the business, age distribution of employees, industry type, and chosen benefits. Small business health insurance costs can vary greatly depending on these factors. Employers should compare multiple quotes from different providers to find an affordable plan that meets their workforce’s unique requirements.

Small businesses may consider obtaining small-scale health insurance for their personnel as a potential means of providing coverage. Before deciding on the right plan for your needs, it is important to be aware of both the advantages and disadvantages associated with traditional small group plans.

Group Coverage Health Reimbursement Arrangements (HRAs)

Small businesses can offer a group coverage HRA to help offset their employees’ health insurance out-of-pocket costs. This option allows employers to contribute pre-tax dollars towards employee medical expenses while still offering traditional group health benefits.

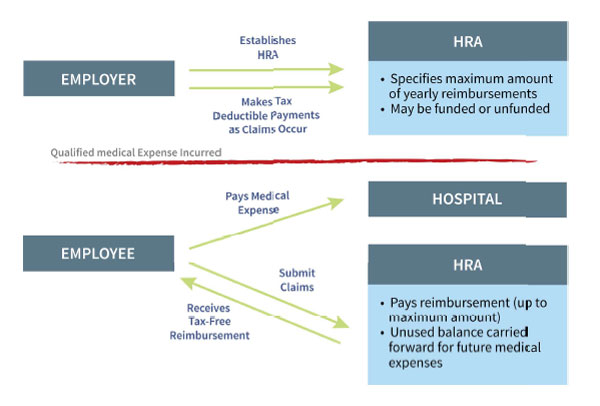

How HRAs Work for Both Employers and Employees

HRAs are employer-funded accounts that can reimburse qualified medical expenses for eligible employees, including deductible payments, copayments, and coinsurance costs. Employers determine the contribution amount and have control over which expenses are covered under the plan. Employees submit claims for reimbursement after incurring healthcare costs.

Eligible expenses covered under an HRA

- Deductibles: The amount paid by the insured before insurance kicks in.

- Copayments: A fixed dollar amount paid by the insured at each visit or service.

- Coinsurance: The percentage of healthcare costs shared between the insurer and insured after meeting deductible requirements.

- Premiums: Monthly payments made by individuals or families to maintain their health insurance coverage.

Employers can take advantage of Group Coverage Health Reimbursement Arrangements (HRAs) to furnish their personnel with monetary aid for health-related outlays. By contrast, Individual Coverage Health Reimbursement Arrangements (ICHRA) offer more flexibility and control over employee eligibility requirements and covered expenses.

Individual Coverage Health Reimbursement Arrangements (ICHRA)

An Individual Coverage Health Reimbursement Arrangement (ICHRA) is an excellent alternative to traditional group health insurance plans for small businesses. With ICHRAs, employers can offer their employees a monthly allowance of tax-free money that they can use to reimburse themselves for individual health insurance premiums and eligible out-of-pocket healthcare costs.

Advantages of using ICHRA over other options

- Flexibility: Employers have the freedom to set their contribution amounts based on employee classes, allowing them to tailor benefits according to their budget.

- No restrictions: Unlike traditional group health insurance plans, there are no minimum participation requirements or restrictive plan designs with ICHRAs.

- Tax benefits: Both employer contributions and employee reimbursements through an ICHRA are tax-free, reducing overall healthcare expenses for both parties.

Employee eligibility requirements for ICHRA participation

To participate in an ICHRA, employees must be enrolled in individual health coverage or a Medicare plan. Additionally, if the employer offers a traditional group health plan alongside the ICHRA option, employees cannot be offered both simultaneously.

Employers can take advantage of Individual Coverage Health Reimbursement Arrangements (ICHRA) as an effective means to furnish health insurance coverage for their personnel, while not having to foot the full bill for standard small business health insurance plans.

Qualified Small Employer Health Reimbursement Arrangement (QSEHRA)

The QSEHRA is tailored to small businesses with fewer than 50 full-time employees that lack other healthcare coverage options. These arrangements allow employers to set aside funds on behalf of their workers, which they can use toward purchasing individual policies or covering qualified medical expenses.

Key Differences Between QSEHRA, ICHRA, and Standard HRAs

- Eligibility: QSEHRAs are limited to small businesses that do not provide group health insurance plans, while ICHRAs and standard HRAs can be offered by companies of all sizes.

- Funding Limits: Unlike ICHRAs and standard HRAs, QSEHRAs have annual contribution limits, currently $5,300 for individuals and $10,700 for families in 2023.

- Tax Benefits: All three types of HRAs offer tax-free reimbursements for eligible medical expenses; however, only QSEHRAs require employees to report the reimbursement amount on their federal income tax return if they claim a premium tax credit.

Compliance Requirements Associated with QSEHRAS

To maintain compliance when offering a QSEHRA plan, small business owners must follow certain requirements. Some key requirements include providing written notice to eligible employees about the arrangement at least 90 days before the beginning of each plan year and ensuring that all employees receive equal contributions based on their family status.

Self-Insurance Options

Some small businesses choose self-insurance as an alternative way to avoid expensive premiums and restrictions associated with group health insurance. By self-insuring, employers assume the financial risk of providing healthcare benefits to their employees and pay claims directly. This approach can offer more control over healthcare costs while still meeting the needs of workers.

Factors to Consider Before Choosing Self-Insurance

- Understanding your business’s risk tolerance.

- Evaluating current employee health status and potential future medical expenses.

- Determining administrative capabilities for managing a self-funded plan.

- Potential need for stop-loss insurance coverage to protect against high-cost claims.

Pros and Cons of Self-Insured Plans for Small Businesses

The advantages of self-insuring include:

- Tailored benefit design that meets specific employee needs without being limited by traditional plans or federal health insurance exchange database requirements.

- Greater cost transparency, allowing better budget management due to direct payment of claims.

The disadvantages may include:

- Increased financial exposure in case of high-cost claims or unexpected medical events among employees.

- Additional time spent on administration, such as processing claims, tracking expenses, and maintaining compliance with regulations.

Health Stipends as a Flexible Option

Health stipends offer another way for small businesses to help their employees with medical expenses without being subject to many regulations associated with HRAs or traditional group health insurance. Employers provide a fixed monthly amount that workers can use toward individual coverage or other eligible costs.

How Health Stipends Differ from HRAs

- Tax implications: Unlike HRAs, which are tax-free, health stipend payments may be subject to payroll taxes and income taxes for both the employer and employee.

- Fewer restrictions: Health stipends do not have the same eligibility requirements and compliance rules as HRAs, making them easier for small business owners to implement.

- Variety of uses: Employees can use their health stipend funds on various healthcare-related expenses such as premiums, copays, deductibles, dental care, or vision services.

Conclusion

Small business owners have several options to provide small business health insurance plans for their employees; traditional small group plans while HRAs like QSEHRA and ICHRA can be more flexible and cost-effective. Self-insurance is another option but requires careful consideration of factors like risk tolerance and cash flow. Lastly, health stipends can be a good choice for businesses that want to offer some assistance with medical expenses without committing to a specific small business health insurance plan.